At SpainDesk, you can get legal advice on legal matters relating to all types of complaints, litigation in court, and civil law in Spain. One of our legal specialisations is in real estate in Spain. Purchasing real estate in Spain and renting it out can be a lucrative business. However, sometimes you might face legal obstacles in Spain. This can be a challenge if you don’t speak the language fluently and don’t know the law. SpainDesk is here to help. Our real estate lawyers and specialists are here to consult with you in English.

We offer legal advice for people that want to invest in real estate

SpainDesk has established lawyers and specialists that can help you with your real estate matters. This way you can securely buy and take your focus elsewhere. Services we offer are:

Company formation in Spain

Desire to have your own company in Spain or want to extend your existing company? Get help from SpainDesk lawyers and get your company formed quickly. We help to find the right solutions for your business project, for instance:

- Choice: We give an option for the legal structure of your new business or subsidiary.

- The establishment office: We help to obtain potential permits and negotiation of the lease agreement.

- Creation of your company: We prepare the power of attorney, your NIE number application, the company’s VAT number, and the deed of incorporation.

Real estate purchasing and renting in Spain

The real estate market in Spain involves certain risks that you need to avoid. Our professionals can offer legal advice so you dream of an apartment or want to buy an office building for your new business. We give the following guidance:

- Reserve contract: sometimes the seller hides unpleasant financial consequences inside of the contract. Contact SpainDesk before signing any contract, so we can advise you and you don’t miss anything.

- Rental contract: the rental of your second home will have tax implications. For example, you could be considered a non-resident. before renting out.

Consult our real estate team in Spain, we can deal on your behalf

Investing in property in Spain is a dream of many foreign investors. The country has a lot to offer. Our team can help you make that dream come true. We can take care of everything and make you reach full compliance with the Spanish tax legislation.

Other benefits at SpainDesk include:

- Advice for choosing your Spanish legal entity

- Easy Spanish company formation

- Safely purchase with legal guidance

- Tax implications are taken care off

- Accounting and administration services

- Contractual advice for renting out

- More services in finance, legal, and business

Get advice from experts that stay up to date with the latest real estate and tax legislation. We are here to help. Connect with us today.

Land registry in Spain

Our Spanish property lawyers will also guide you through the purchase of your property and can take care of many aspects such as registering such as properly registering your property.

Registration will be done at the Spanish land Registry. The Spanish land registry is a public and universal, national and autonomous institution of the State. Its purpose is to safeguard and keep records on property rights, including their modification and cancellation.

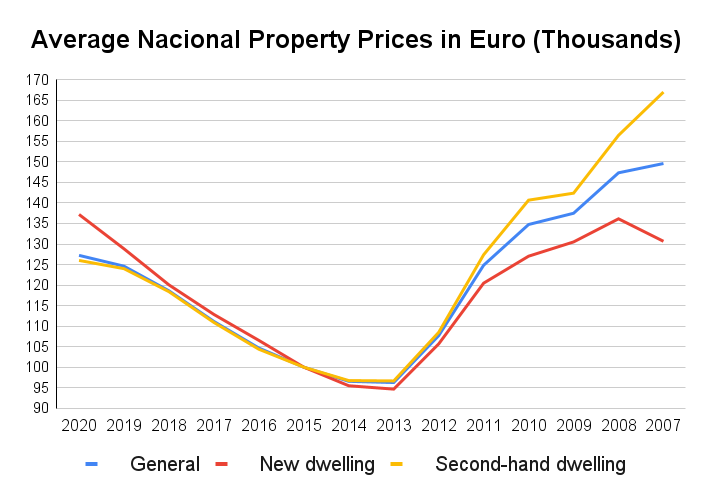

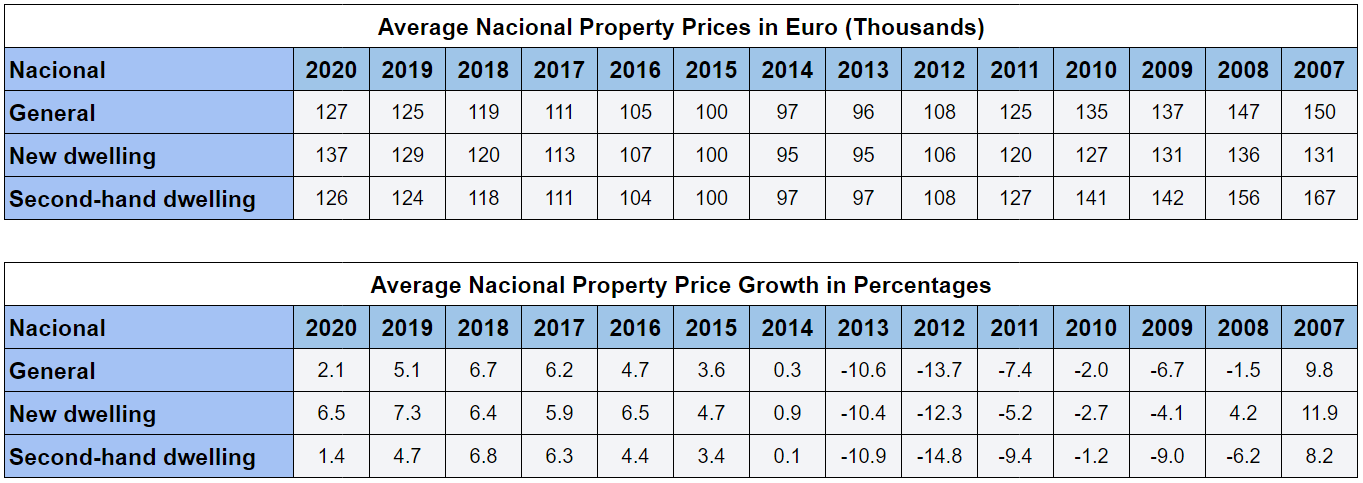

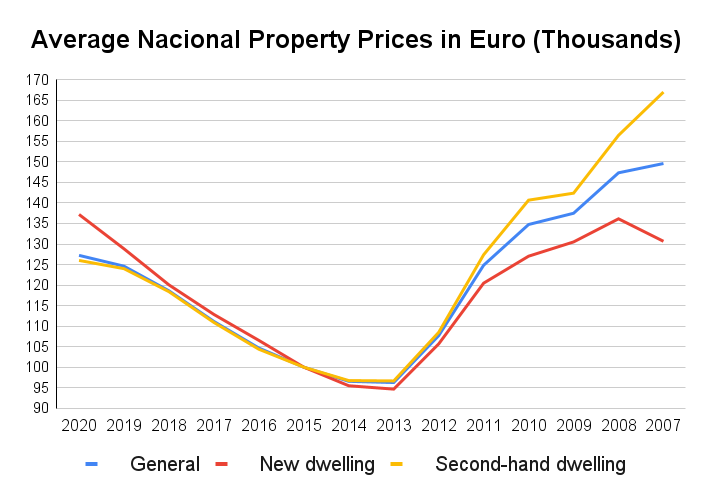

Average property prices in Spain

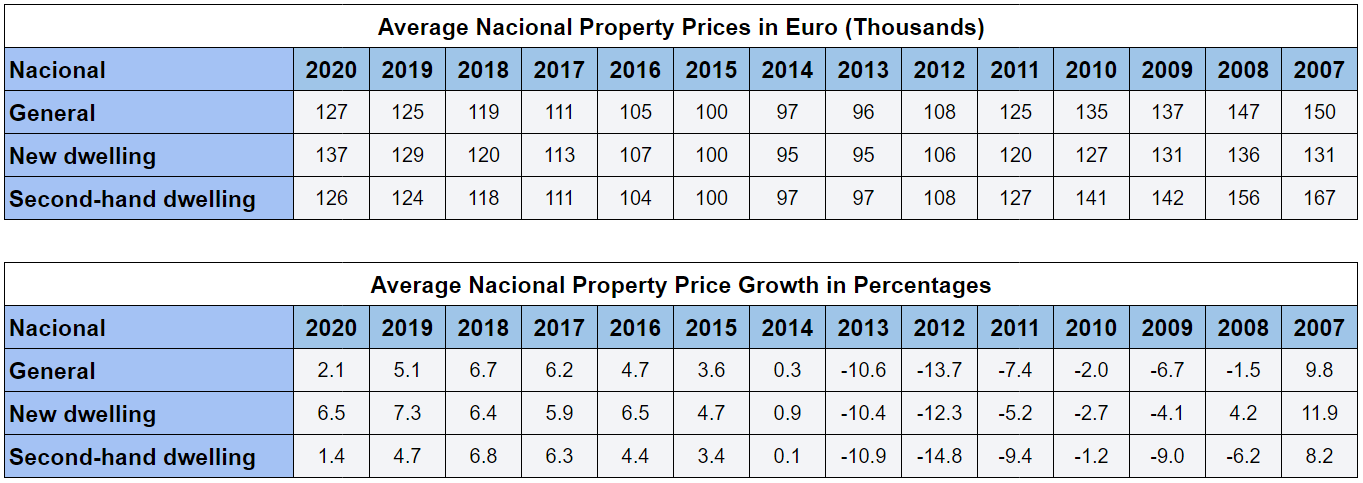

Property prices in Spain continued to grow over the last two years. The average price of a property in Spain was 127.000 euros compared to 125.000 euros in 2019, and 119.000 euros in 2018.

While property prices in Spain continued to grow over the last two years. The average growth rate (new dwellings + second-hand dwellings) decreased from 6.8% in 2018, to 5.1% in 2019, and 2.1% in 2020.

While real estate investment has not been as popular as it was during the rapid growth of Spain, there has been an increase in demand for real estate over the past few years.

Average property prices of new property in Spain

Property prices in Spain continued to grow over the last two years. The average price of a property in Spain was 137.000 euros compared to 129.000 euros in 2019, and 129.000 euros in 2018.

The average house price value of new property in Spain grew by 6.5% in 2020, compared to 7.3% in 2019, and 6.4% in 2018. This means that new houses in Spain are getting more and more popular among investors.

The value of new real estate has continued to rise, although at a slower rate than in prior years.

Average property prices of second-hand property in Spain

Property prices in Spain continued to grow over the last two years. The average price of a property in Spain was 126.000 euros compared to 124.000 euros in 2019, and 118.000 euros in 2018.

The average property prices of second-hand Spanish property grew by 1.4% in 2020 compared to 4.7% in 2019, and 6.8% in 2018. This means that property prices increased at a slower rate in 2020 than in 2019 and 2018.

The growth of prices of second-hand properties in Spain slowed down quite a bit. Which is something that you should keep in mind when doing your next property investment.

Reasons why people enjoy living in Spain

The Cost of Living – For many, the cost of living is a significant factor for choosing their next destination. Spain has become one of the most popular destinations in Europe thanks to its great weather, good infrastructure and relatively low cost of living.

Climate – Spanish weather isn’t too extreme with mild winters, warm summers and stable temperatures year-round. The climate also encourages outdoor activities which is another reason people enjoy living here.

Popular autonomous regions foreigners buy property in Spain

Among the most popular autonomous regions to buy property in Spain are Andalucia, Catalunia, Murcia, Canary Island, Valencia, Madrid, and the Balearic islands. Below we discuss the reasons why people are buying property in these locations, as well as the prices of these increases.

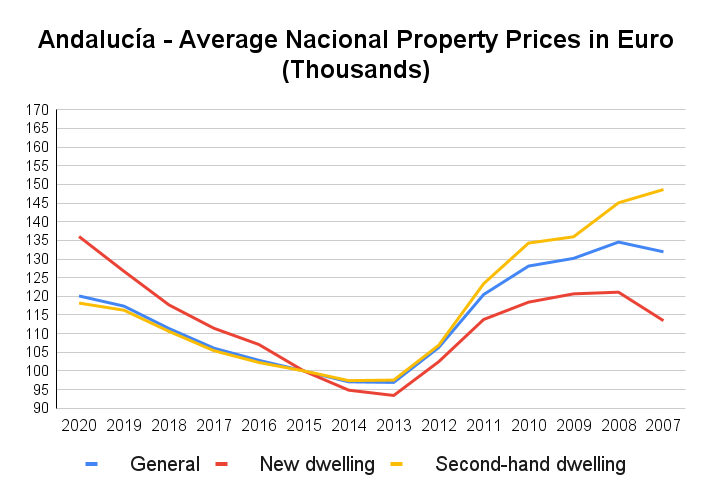

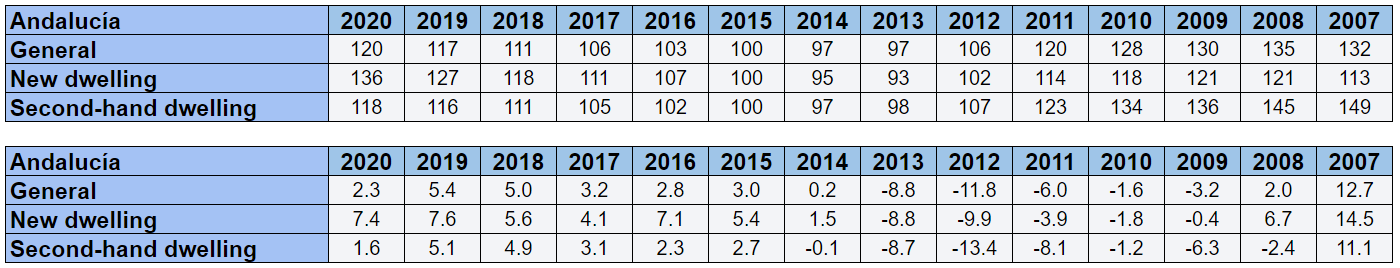

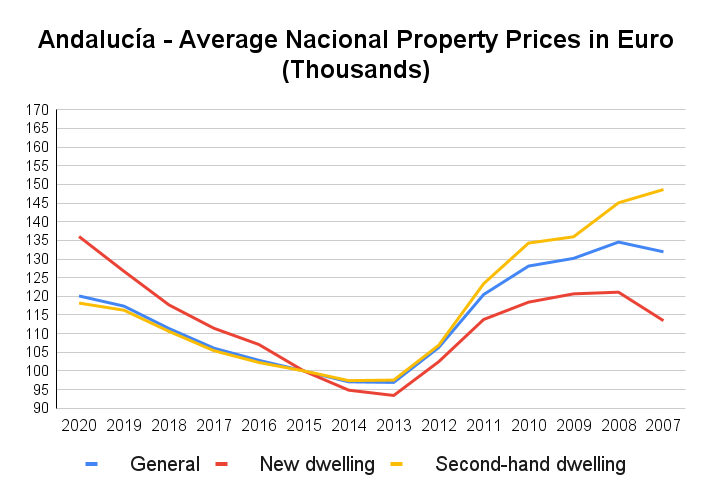

Property market in Andalucia

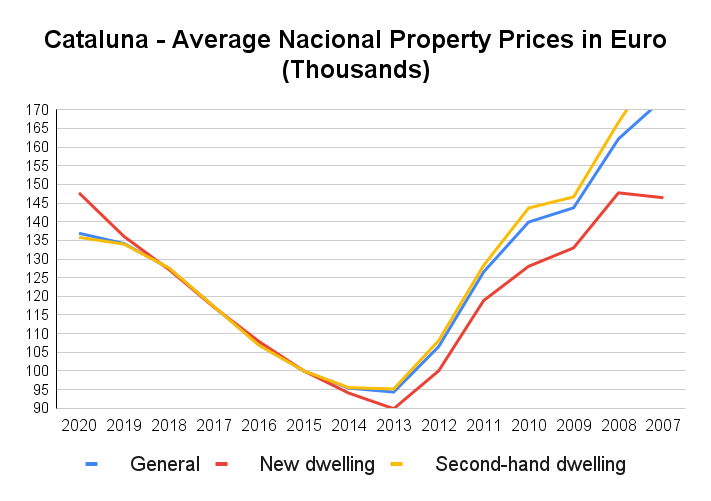

Property prices in Andalucia continued to grow over the last two years. The average price of a property in Spain was 120.000 euros compared to 117.000 euros in 2019, and 111.000 euros in 2018.

The average property prices grew by 2.3% in 2020 compared to 5.4% in 2019, and 5% in 2018. This means that property prices increased at a slower rate in 2020 than in 2019 and 2018.

Reasons why people are buying property in Andalucia

Andalucia is a popular place to buy property in Spain. Andalucia has many qualities to offer such as excellent climate, both in coastal towns and inland.

Almeria is located in the southeast part of Andalucía and has a very warm climate throughout the year. It is a popular city made up from a mix of traditions and modern culture.

In the west part of Andalucía, where it’s also sunny all year round, you can find Cádiz. This region has many historical monuments which will make it a great place to live. Parts of the Costa del Sol are also located in Andalucía, which is popular as a hot climate with around 300 days of sunshine per year. This area is popular among people who are looking for a good holiday home with lots to do throughout the year.

- A near perfect climate that brings with it sun-drenched beaches and blue skies the majority of the time.

- An affordable lifestyle yet with many comforts, especially in the south where property prices seem to be permanently fixed well below those in other regions of Spain.

- Andalucia has a very attractive cultural life, with an abundance of festivals all year round.

- The area offers many activities to occupy your time, be it water sports in the coastal areas or mountain sports in the Sierra Nevada range – excellent for hiking and climbing.

- Alternatively simply enjoy Andalusian sherry or wine on one of the many terraces of the Alameda parks.

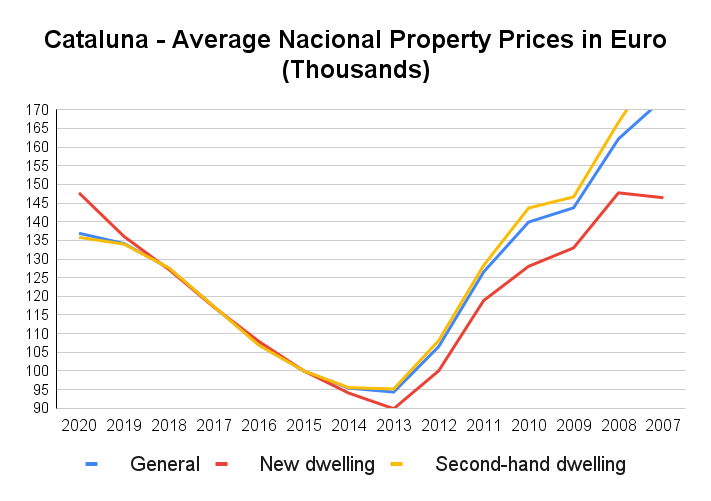

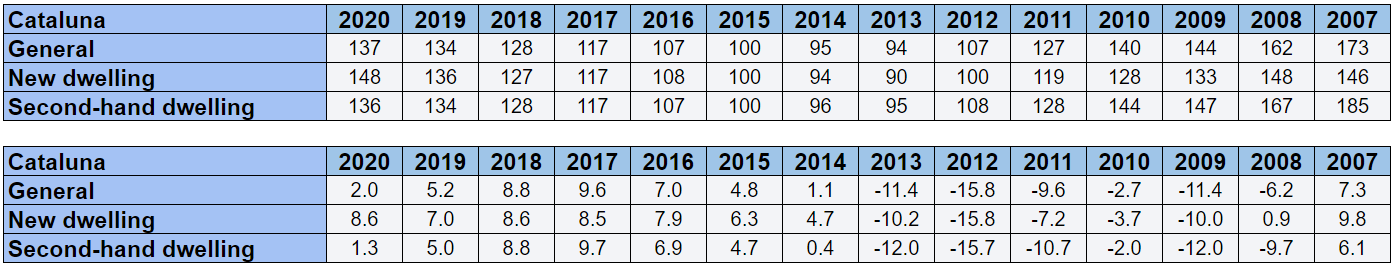

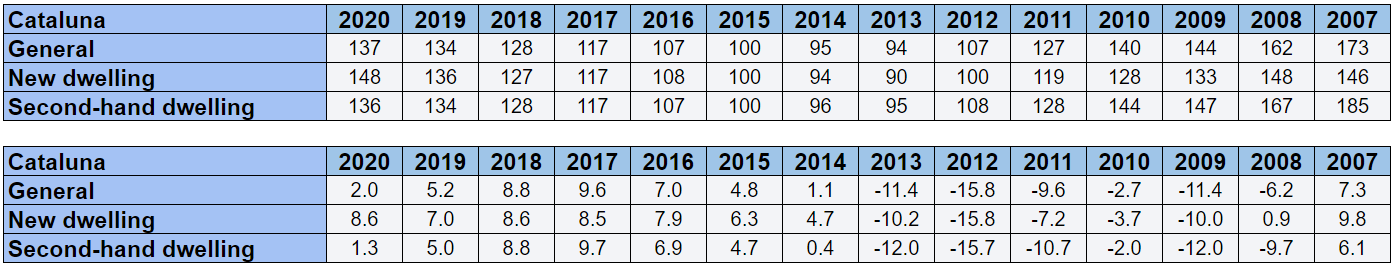

Property market in Cataluña

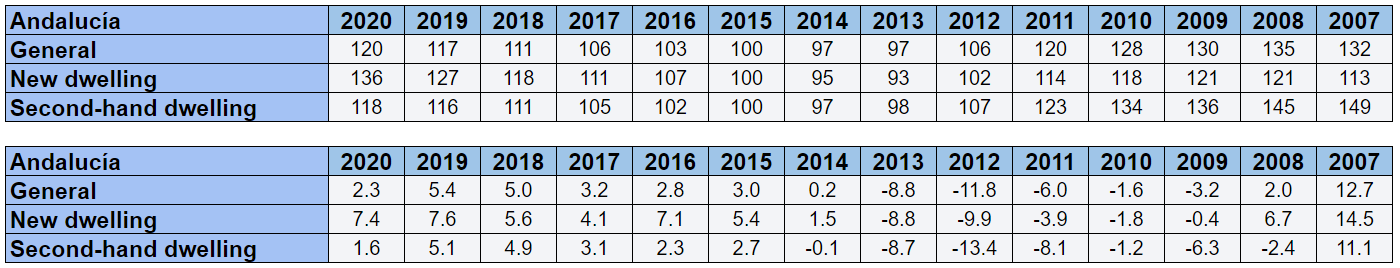

Property prices in Cataluna continued to grow over the last two years. The average price of a property in Spain in 2020 was 134.000 euros compared to 134.000 euros in 2019, and 128.000 euros in 2018.

The average property prices grew by 2.0% in 2020 compared to 5.2% in 2019, and 8.8% in 2018. This means that property prices increased at a slower rate in 2020 than in 2019 and 2018.

Reasons why people are buying property in Cataluña

Cataluña is another one of the most common places where foreigners buy property. Catalonia has a lot to offer with many different styles of homes and areas. There are several popular home buying regions in Catalonia that attract buyers from around the world, including Costa Brava.

There are many places in Cataluña you can buy property. Barcelona is one of the best places to buy property in Catalonia. Barcelona has many attractive things for people who want to live there.

- Catalonia is a very safe place in Spain, especially in Barcelona where the crime rate is extremely low. The police presence is also high and the general public gives it that good vibe (Surveys show that citizens feel happy and proud of living in Barcelona).

- Barcelona and its surrounding towns and villages offers an abundance of activities from outdoor activities to culture, art & cable cars to reach the mountain tops etc. There is also lots of nightlife with a large variety of places for whatever taste you might have (from glamourous clubs to bars and restaurants where people are at until midnight).

- Barcelona is well-known for its markets especially La Boqueria where you can buy the best fresh produce and fish. Also, they have stylish shops in Barcelona’s old town with fashion designers’ boutiques, jewelers etc.

- Catalonia has some of the best natural parks in Spain such as Montserrat, Aiguestortes, La Garrotxa etc. Next to this, Catalonia is a very “green” region where most people see it as their duty to recycle and they enjoy doing so.

- Catalonia is one of the most open minded regions of Spain and people are very polite and friendly with foreigners, which you don’t find in certain places of the country.

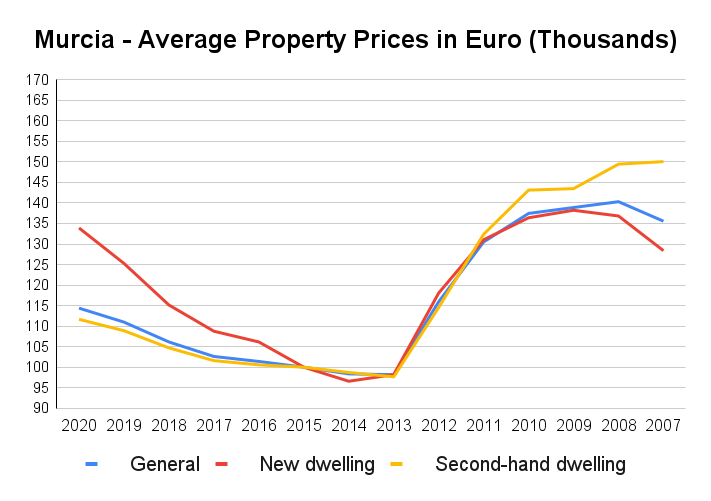

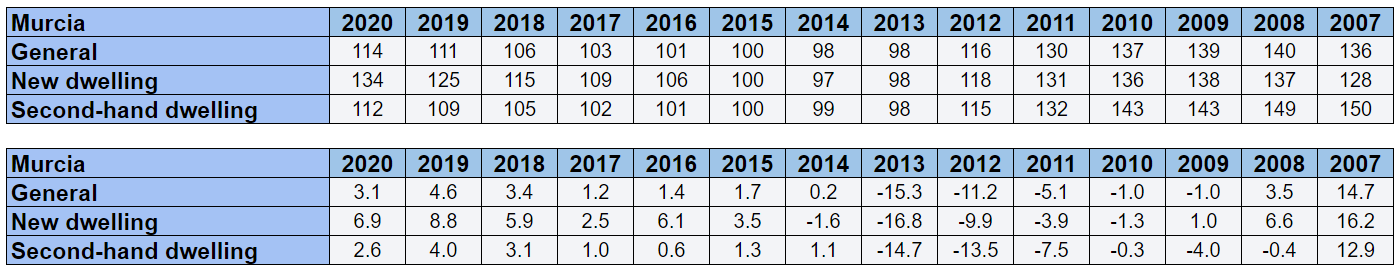

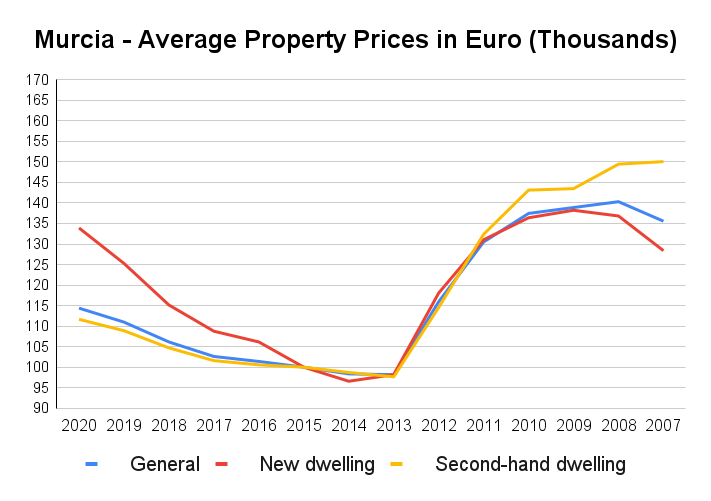

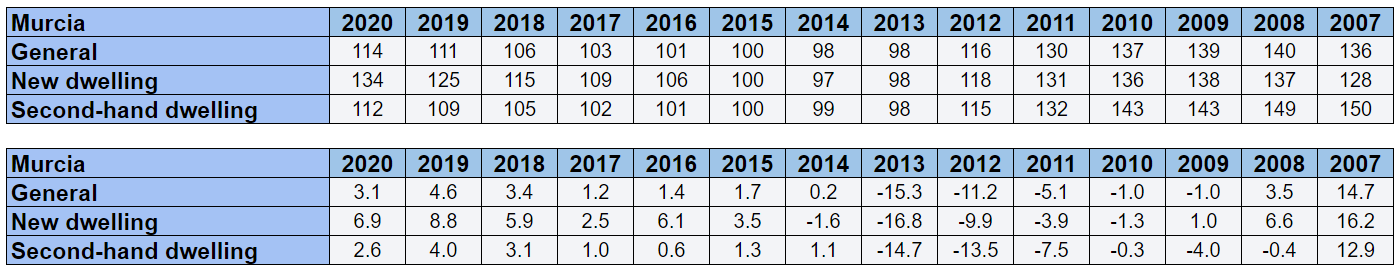

Property market in Murcia

Property prices in Murcia continued to grow over the last two years. The average price of a property in Spain in 2020 was 114.000 euros compared to 111.000 euros in 2019, and 106.000 euros in 2018.

The average property prices grew by 3.1% in 2020 compared to 4.6% in 2019, and 3.4% in 2018. This means that property price increase remains stable in Murcia.

Reasons why people are buying property in Murcia

Murcia is located in the southeast of Spain. It’s a popular place to buy property because of its good climate and affordable prices. The most visited region in Murcia by foreigners is El Carpio de la Jara, with its 17th century palace and plenty of natural parks.

Murcia also has rural areas like Carboneras with beautiful beaches and lots to do outdoors.

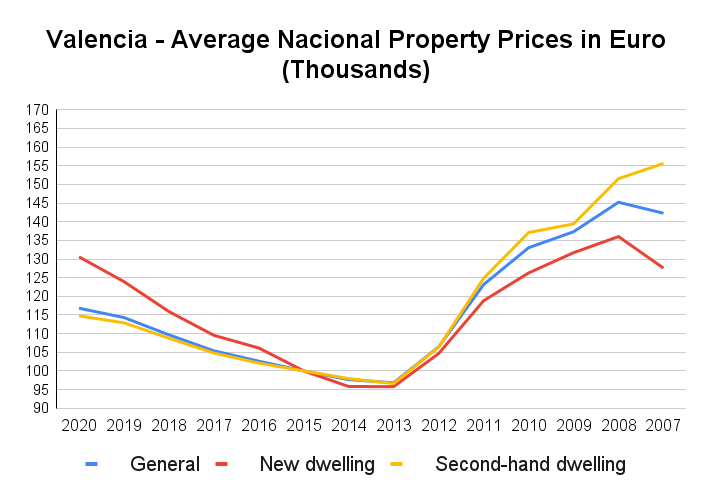

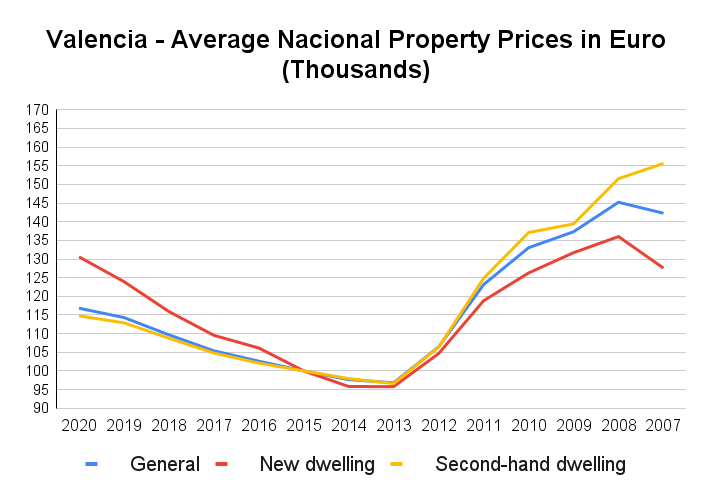

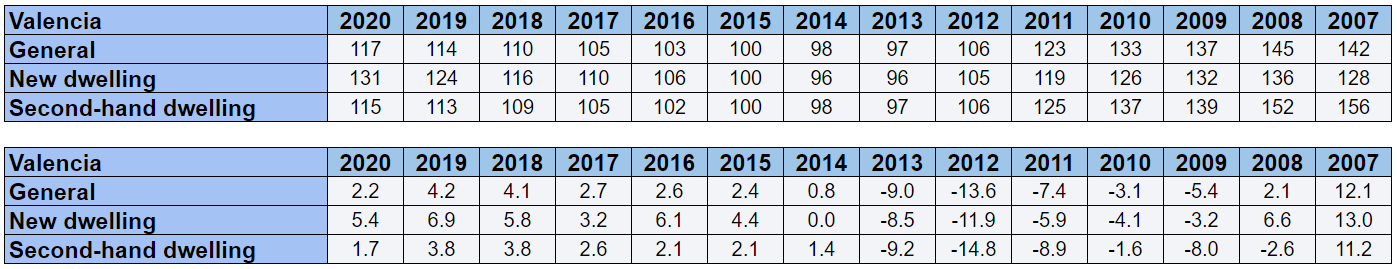

Property market in Valencia

Property prices in Valencia continued to grow over the last two years. The average price of a property in Spain in 2020 was 114.000 euros compared to 111.000 euros in 2019, and 106.000 euros in 2018.

The average property prices grew by 2.2% in 2020 compared to 4.2% in 2019, and 4.1% in 2018. This means that property growth decreased in Valencia.

Reasons why people are buying property in Valencia

Valencia is an ideal place to buy property. The climate is warm all year round and the beaches are close by. There are many cultural activities that make it into a great place to live.

Valencia, located in the east of Spain, is an ideal place to buy property. The climate is warm all year round and the beaches are close by. There are many cultural activities that make it into a great place to live. Valentia offers many different types of real estate projects which will be perfect for different people.

Valencia is located in the east of Spain. It’s surrounded by mountains and has a strong agricultural economy, which makes it an ideal place to buy property.

The most visited region in Valencia by foreigners is La Marjal, with its low prices and beautiful green surroundings.

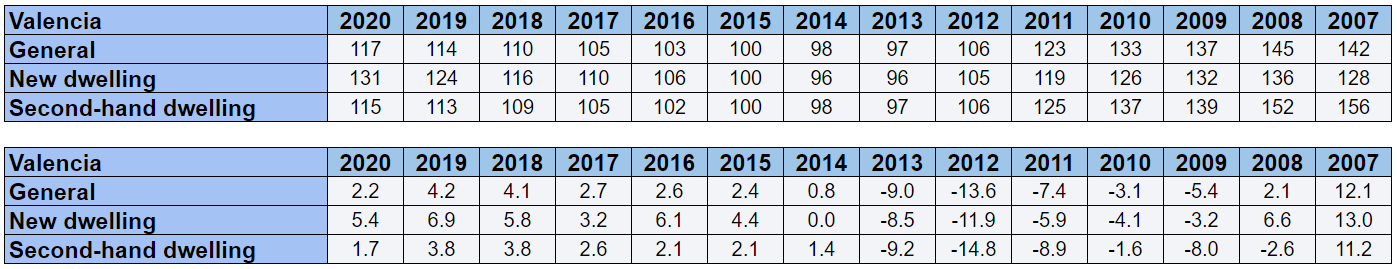

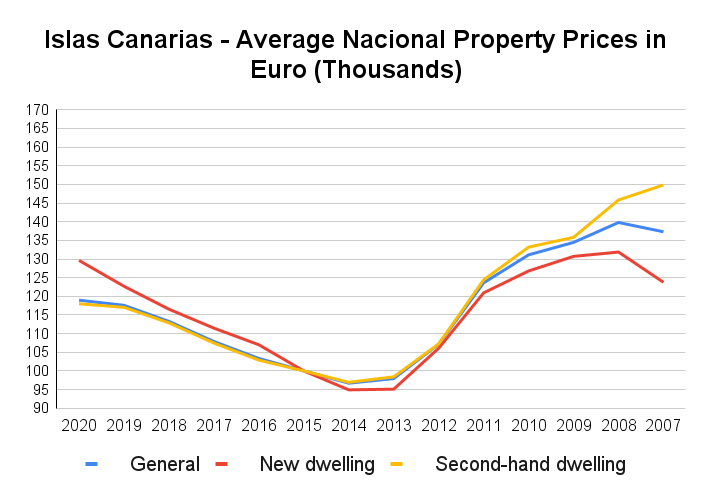

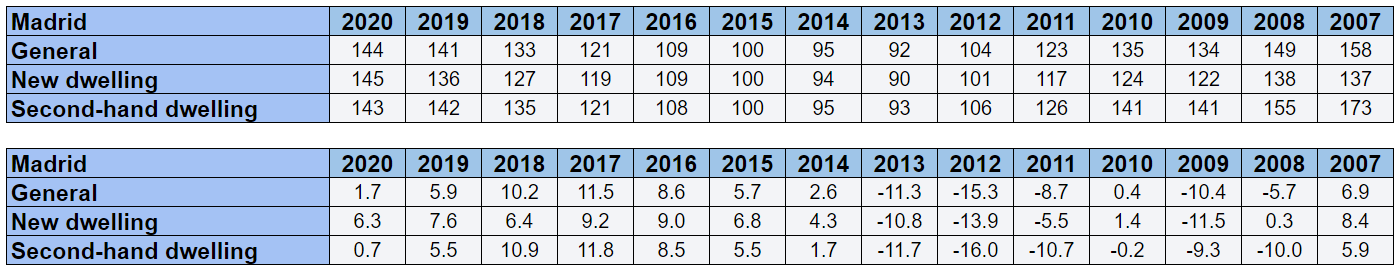

Property market in Madrid

Property prices in Valencia continued to grow over the last two years. The average price of a property in Spain in 2020 was 144.000 euros compared to 141.000 euros in 2019, and 133.000 euros in 2018.

The average property prices grew by 1.7% in 2020 compared to 5.9% in 2019, and 10.2% in 2018. This means that property growth decreased rapedly in Madrid.

Reasons why people are buying property in Madrid considered

Madrid is also a popular investment location, the prices has increased significantly. Madrid is one of the most interesting investment regions in Southern Europe.

The rental market is also very favourable, especially when compared to other markets in Europe where demand is extremely high. In addition, Madrid is a city with an excellent quality of life and offers all types of services.

A list of reasons for people to live in Madrid are:

- Madrid is a large and dynamic city with many cultural, social and leisure activities.

- It is a very safe city with one of the lowest crime rates in Europe.

- The standard of living and life quality in general is very high.

- Madrid is a city with a great international projection and a large concentration of multinationals.

- The city has excellent infrastructure: transport, roads, telecommunications… Madrid also benefits from two airports (Barajas and Torrejon), several railway stations to connect the capital with the rest of Spain and Europe (AVE), as well as extensive road networks.

- The academic offer is broad and varied: the city offers a university for each of its citizens, having more than 350,000 students. Furthermore, it has a network of public and private schools that guarantee education at all levels.

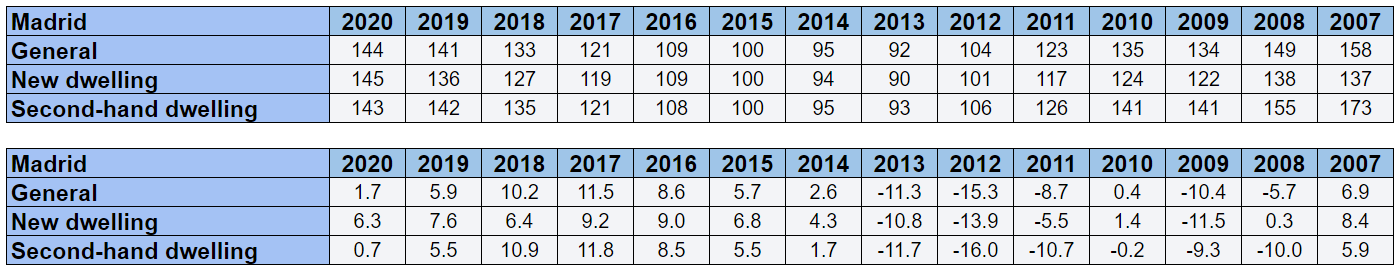

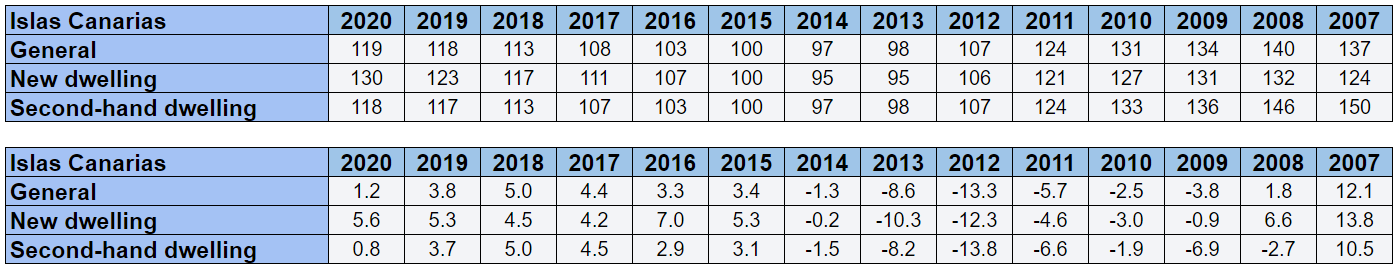

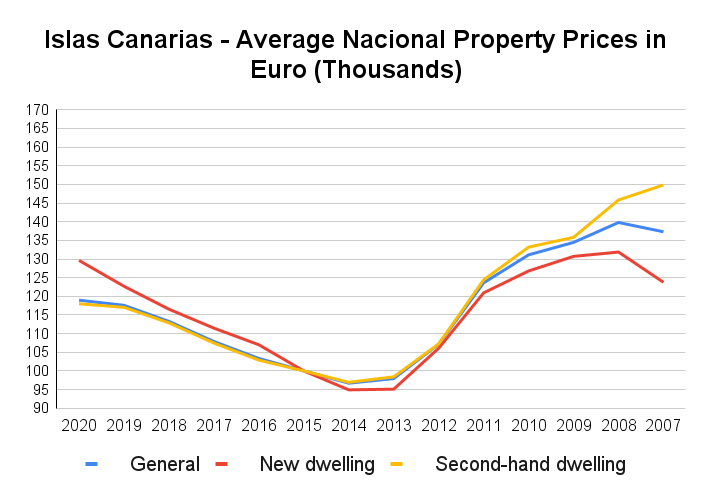

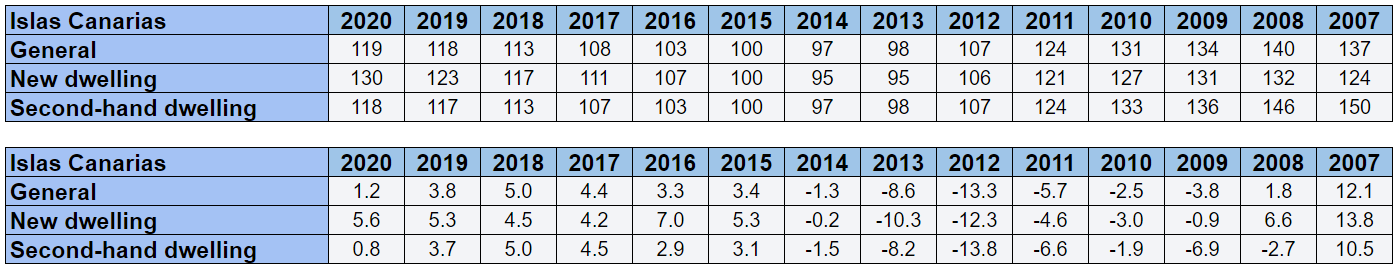

Property market in Canary Islands

Property prices in Canary Islands continued to grow over the last two years. The average price of a property in Spain in 2020 was 119.000 euros compared to 118.000 euros in 2019, and 113.000 euros in 2018.

The average property prices grew by 1.2% in 2020 compared to 3.8% in 2019, and 5.0% in 2018. This means that property growth decreased rapedly in Madrid.

Reasons why people are buying property in Canary Islands

If you would prefer to investing in beach-front property, the Canary Islands are a good choice. There is a variety of properties to choose from all with different names and prices.

The Canary Islands are situated in the Atlantic Ocean between Africa and Europe. This group of islands is made up by seven major islands, including La Palma, Tenerife, Gran Canaria, Fuerteventura, Lanzarote, La Gomera and El Hierro.

The region offers diverse climate climates that range from hot and dry to humid and wet. Buyers can choose between beach properties on the coast or mountain retreats inland. Popular cities on the canary islands

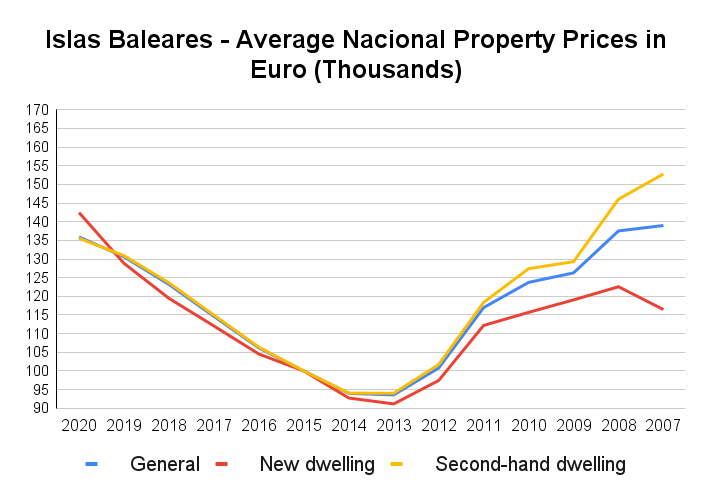

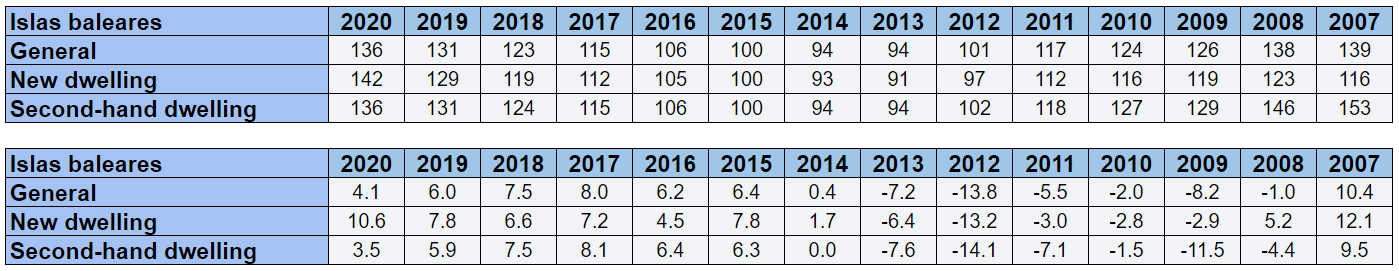

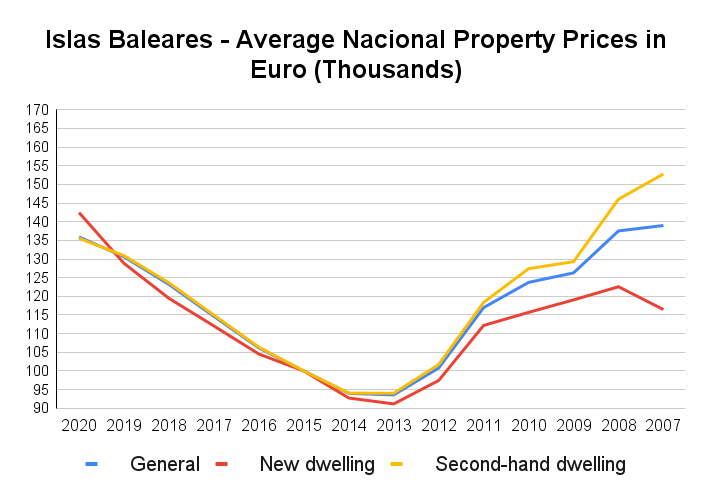

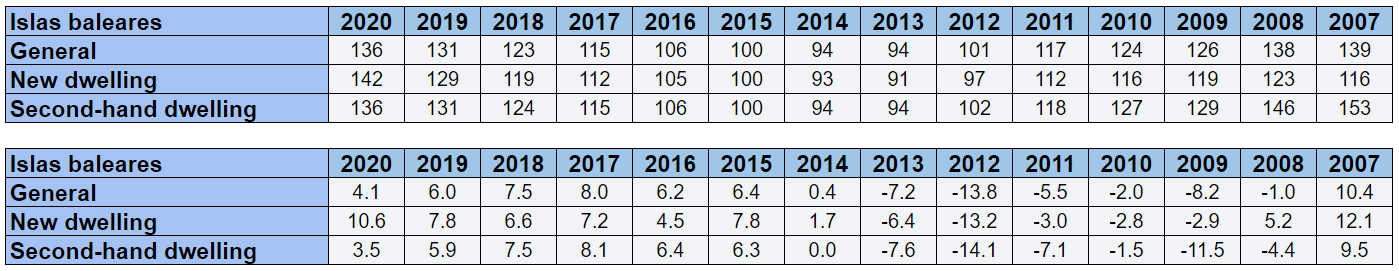

Buying property in the Balearic Islands

Property prices in Islas Baleares continued to grow over the last two years. The average price of a property in Spain in 2020 was 136.000 euros compared to 131.000 euros in 2019, and 123.000 euros in 2018.

The average property prices grew by 4.1% in 2020 compared to 6.0% in 2019, and 7.5% in 2018. This means that property decreased in the Balearic Islands, but not as fast as in other regions.

Reasons why people are buying property in Balearic Islands

If you would like to live in one of the most popular places for foreigners wanting to purchase property, the Balearic Islands is a good choice. But with all these choices, it can be hard to know which one is best for you. Palma de Mallorca offers a warmer climate and more affordable prices with a variety in homes in different areas of the city. Majorca has a mild climate year round and less expensive properties with beautiful views from terraces overlooking the bay. Ibiza is more expensive but offers an active clubbing scene along with beautiful beaches and various homes styles from contemporary to traditional Mediterranean style villas. Menorca is cheaper, but also has less varied options in housing.

Property buying a residency in Spain

Buying property in Spain by non-residents

Non-resident buyers need to present a bank letter of guarantee for the purchase price agreed with the seller. They also need to provide proof that they have sufficient funds available in the country’s banking system.

Buying property in Spain by residents

The process to buy your first home as a resident is quite straightforward. All that needs to be done is show up at the notary office with your NIE number and a few copies of your documentation. The requirements to buy a house in Spain are the following:

- Proof of home ownership where you live, or evidence that it will be inherited soon.

- Proof that you have sufficient funds available in the country’s banking system.

For non-residents renting out their primary residence: In the event of a rental contract, there are certain requirements you need to fulfill in order to be considered a non-resident. For instance, if the tax authorities find that you spend more than 183 days a year in Spain or more than six months a year on average, you will have to pay taxes on your property. These sanctions can be avoided by sending proof of your absence from the country during various periods of the year.

Rental income tax in Spain

Rental income is subject to a 30% tax rate in Spain. This can be reduced by claiming expenses, such as those incurred from the maintenance of the property.

The tax implications of Spanish property investment

In Spain, when you buy a property, you will have to pay a property tax. For instance, when buying a new property in Spain, the buyer has to pay 1% of the purchase price in stamp tax. Next to this, you will also have to pay VAT on these properties.

When you are buying a send hand property you will have to only pay ITP. The ITP rate depends on the region you are situated in.

Frequently asked questions

Below you can find some frequently asked questions on the Spanish property market.

Why should I use a company for my real estate investment in Spain?

Reasons why you should use a company to invest in Spanish property, numerous. First of all, it allows you to have certain tax benefits that regular individuals don’t usually enjoy. Secondly, it allows for more advanced legal structures. Finally, there are added benefits when you buy Spanish property through a company. For example, you can avoid having all the legal fees and taxes associated with acquiring property in your name.

What are the benefits of investing in property in Spain?

There are a few benefits that come with investing in the Spanish property market. Property brokers in Spain point out that most house prices in Spain are relatively low, especially when compared to other European countries.

What is the process for buying and renting out property in Spain

There are different procedures to follow, depending on who is the buyer and what type of property is desired. For instance, if you’re a foreign buyer and want to buy an apartment in Spain, there will be different requirements and difficulty levels than someone who is a Spanish citizen and wants to renovate their primary property.