Buying a property in Spain can seem like quite the task, but it doesn’t have to be. Here we will cover what you need to know before buying Spanish property and some of the best ways to find properties for sale. This article is meant as a guide for those looking into purchasing their own home or investment property in this beautiful country to make an informed decision on whether or not Spain is right for them.

Is buying property in Spain a good idea?

There are two reasons why people would want to buy a property in Spain. The first reason is to live in Spain, and you can do this by buying a property to live in full time or by buying a holiday home. The second reason is to purchase property as an investment.

Get the help of a Property Lawyer in Spain

Buying property in Spain for living

Spain as a place of living – Spain is a beautiful place to buy a house. People love Spain for its weather, beaches and culture. People live day by day relaxed and stress-free, making the most of their time relaxing on the beach or enjoying every single moment to spend with family. Of course, there are many more things that you can do (if you want), but this is the typical Spanish way of living.

Spain is a trendy place to live because of its nice weather and beautiful beaches and its fantastic culture and history. Many people decide to buy property in Spain considering this since we have several different options depending on our needs and budgets: apartments, villas or even luxury houses with private swimming pools.

Buying property in Spain to invest

There are many reasons why investing in Spanish property exists. The first reason is the same as the previous one: it’s due to great weather and beautiful landscapes such as beaches and its great culture and history. But there is another important thing in Spain that makes it attractive for property investment.

Spain is one of the most visited countries in the world. Millions of tourists visit Spain every year attracted by its nice weather, beautiful beaches and fantastic culture. With this great tourism industry comes a very strong commercial property market with a generous offer in different sectors, including retail, commercial, office and logistics.

The second reason people would buy a property in Spain as an investment is its economic stability. Spain has been showing important economic growth for several decades now, attracting many investors looking to invest in the Spanish economy.

Property buying Spain: Influence of nationality

Whether you are a Spain resident or non-resident, you can still buy a property in Spain. However, there are some differences that you need to take into consideration.

- Non-residents: Being a non-residence requires a unique NIE number, “Número de Identificación de Extranjeros,” for the sale to happen following the Spanish property legislation. We can help you get your NIE, contact us, and our lawyers will take care of it.

- Resident: There are no minimum requirements for residents or citizens of Spain when buying a property in Spain.

Language and buying property in Spain

This has proved to be a significant constraint in closing deals unless you speak fluent Spanish. This can be a barrier to those who do not know the language as you must understand Spanish legal documents and regulations.

Buying property in Spain has some peculiarities. If you want your first deal, we recommend hiring a bilingual real estate agent with the experience to help you through all stages of buying: from finding your dream house to closing the deal.

We also advise you to find a bilingual, independent lawyer with experience in Spanish land and property law to help you buy your property in Spain. This lawyer will help you throughout the buying procedure, ensuring that all procedures are correctly followed and done legally. A good lawyer can also offer you translation services if your Spanish is not fluent enough to read documents in the Spanish language. We offer these services, so do not hesitate to contact us for further information.

How to choose a location to buy property in Spain?

Spain is an attractive choice when considering buying a property, but finding the right one requires a significant effort. First, you will need to ask yourself the practical question, “what do you want?”.

- Do you want to buy a property as an investment or for your personal use?

- Are you looking for a permanent home or seasonal retreat?

- Are you looking more to the South of Spain, Mediterranean coast, Costa Blanca, Costa del Sol, Costa Brava, etc.?

- Are you looking for a mountain view and cooler temperatures?

- Are you looking more to the North of Spain, Atlantic coast, Costa Daurada, etc.?

- Are you looking for beach views and warmer temperatures?

- Are you looking for an apartment, country house, villa, or bargain property?

As you can see, you have to ask yourself many questions before you start your property journey. Next to knowing what property type you are looking for, you also have to ask yourself if you want to work with a real estate agent. When buying in a foreign country, dealing with a property expert from that country is always recommended. When buying property in Spain, it is best not to run into any problems because they are harder to fix when you don’t know the property scams, pitfalls, and right pricing. A trusted real estate agent can help you with this.

Getting a real estate agent involved

You can find a real estate agent in most Spanish towns and cities; we recommend choosing the most reliable one, not necessarily the cheapest. They usually charge between 3% and 6% of the final purchase price. If you are looking for a free service, make sure that you know what they will be offering in return (this is where property scam cases come up).

We have defined three general types of real estate agents you can choose from:

Agency real estate agents

This type of agent is responsible for the business of selling properties on behalf of different owners, representing them legally. They can also help people find properties on the market.

Independent real estate agents (freelancers) / Personal shoppers

Offer the same services as agency real estate agents but are not representing a specific seller or owner. They usually work remotely, online, and work to get the best price for your property.

Property developers

They design and build properties but do not sell them. Once the construction is over, they advertise and sell rooms or flats to individual investors or companies. If you are interested in buying a property from a Spanish developer, you will be required to pay additional costs for the new build, such as up-front payments and deposits. Sometimes this fee is added to the selling price of the property, so the developer can recover fees they have paid out before selling it to you. This is not to be confused with the developer’s profit margin, which should remain separate.

Charges for buying property in Spain

The average property commissions range from 1% to 5%. The percentage of the house’s total value is usually lower for properties that are not located in large cities, while it tends to be higher if you are buying a home in Madrid or Barcelona.

Finding a property on the internet

The internet has become an excellent source for finding real estate listings and contact details. In addition to this, there are many property portals both in Spanish and English that provide more information on each listed property, including photos, the current status of the projects and the number of bedrooms and bathrooms. On portals like Idealista, you can find customer comments concerning their experiences with the listed real estate agencies.

Some realtors offer a service called “virtual tours”, which are 360-degree images of the property that allow you to feel as if you were there or even walk through it to see all parts of the building.

Popular locations to buy a house in Spain

The most popular areas to buy a house in Spain are the coastal regions – Costa Blanca, Costa del Sol, and Costa Brava – because of their mild climate and beaches. They are also popular because they are close to Valencia, Alicante and Barcelona.

The Costa Blanca and Costa del Sol are both in the south of Spain. The Costa del sol has a dry climate with little rainfall, while the Costa Blanca has a more humid, rainy season from October to March.

The Costa Brava has a milder climate than the other coastal regions and is more protected by mountains, and it also has more rainfall and fogs than the other two coasts.

Costas: The coast can boast of many attractions, such as international airports, big cities close by and good nightlife, which attracts foreign people looking to move permanently to Spain

Take the legal steps

Unless you want to go through the stress of buying a home yourself, we recommend hiring a Spanish property lawyer to help you through the stage of legal requirements stated below.

Signing the “contrato de Reserva”

A purchase contract fee of 3.000 to 6.000 euros expresses your interest in buying a property and gives the power to remove the property from the listing within a duration of 14 to 21 days.

Sign the “contrato de Arras”

This is a private contract that requires you to pay a deposit of 10% of the property worth within ten days.

Get the Nota Simple

A document provided by the registry of properties that identifies the proprietor of the property.

Certification of domain and charges

This document guarantees the genuineness and fiscal security of the property, which is signed directly by the registrar. Additionally, it includes details on charges or debts, mortgages, embargos, or pending lawsuits on the property at the time of issue.

Inscription in the Registry of Properties

This process transfers the property’s ownership from the previous owner to you.

Communication to the Catastral office

A notification from the registry of lands and buildings regarding your property acquisition is sent to the Catastral office. This division produces a map of properties with their respective values. A tax is charged for the updating of this file.

Changing the name on utility bills

You need to get new bills with your name since the property’s previous owner used for utilities is part of the records.

Copy of title deed

When making the purchase official, you can receive an Escritura. This document is the physical proof of the property.

Community ownership documents

It’s mandatory for the person buying property in Spain to contribute to the community in Spain, an amount based on how many square meters you own.

Buying a property is complex, and our property lawyers can help you with the entire process. Contact us today, and get a free quote.

Property taxes and costs

When you buy property in Spain, many taxes and costs are involved. Among these costs are property transfer tax and notary fees. If you want to rent out your property, other costs will also play a role. We have dedicated a post about the costs involved when buying property in Spain.

Notary costs

These are fees charged by the notary in charge of writing up your promises related to ownership. This cost can be shared between both parties or paid entirely by only one party.

Agent fee

An agent is a person who works with the specific goal of finding a property for you. The buyer and seller can each pay a fee to their agent, or the agent can work together and agree on one fee from the buyer.

Lawyer fee

The property lawyer’s task is to ensure that all legal proceedings are carried out correctly. The lawyer will create the (governmental) forms and contracts needed to acquire the property. They will also make sure that the rights of both parties are recorded in the documents, that all taxes are paid in full, and that your real estate agent or other party involved is not doing anything illegal.

Buying land to build a new property in Spain

When you want to build a new property, several steps are involved. Firstly, of course, you will need to buy land in Spain where you can obtain building permits for. If you don’t have the patience required to follow through with finding land, SpainDesk has specialists who can help you buy land and obtain the appropriate building permits.

Secondly, you need to choose an appropriate location for your property. You need to be specific on the area of your property, the orientation you want it to have, whether you want a garden or have other specifications are taken into consideration.

Thirdly, you will need to get the architectural plan approved by the town hall (Ayuntamiento) before the building starts. This step can take up to 6 months or longer since the construction must fit with the local architecture of the area.

Finally, once all requirements are met, you will begin construction. This can take several months depending on the size of the building and, more importantly, where you live within Spain.

Since this process can take some time, SpainDesk has experts who can speed up land buying and obtaining building permits. Contact us today, and our lawyers will help you with your case.

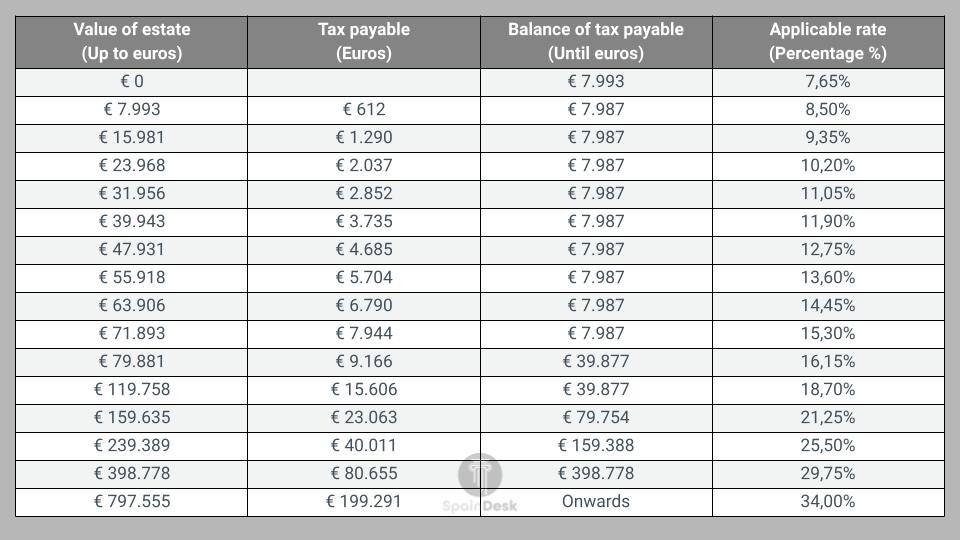

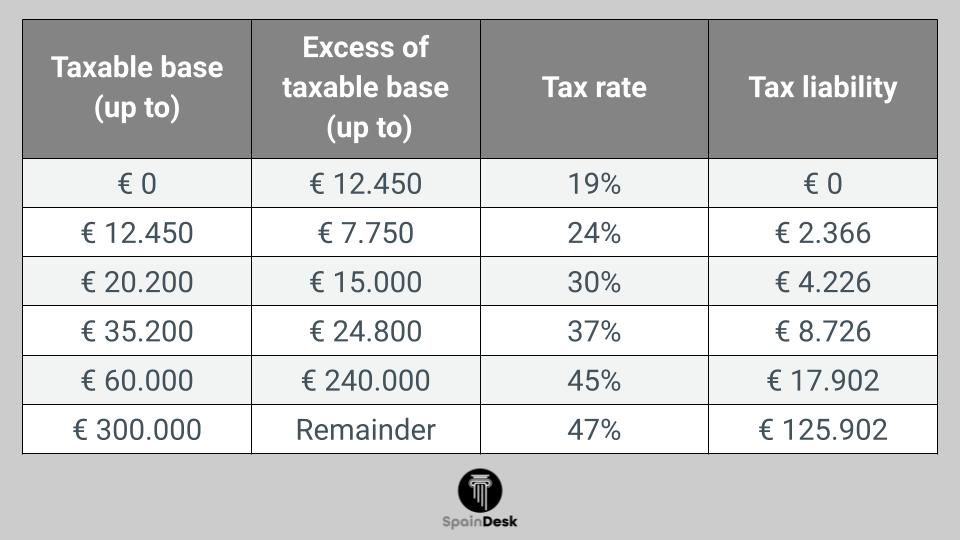

Taxes to buy a house in Spain

The amount of property tax in Spain charged by the Spanish government varies depending on whether you purchase a new property or a resale property. The term “New” refers to a property that has never been sold before, and it’s usually purchased straight from the developer in this case. The term resale is used to describe properties that have previously been sold.

New property taxes

New property owners will have to pay the following two property taxes:

- VAT (IVA): 10% of the purchase price.

- Stamp duty: 1.5% of the purchase price. The stamp duty is paid to the Spanish land registry, and it is a kind of land registration fee. The stamp duty needs to be paid for every new property purchase, and it’s one of the costs that need to be included in your budget when buying a house in Spain.

Resale properties

There is only one tax on resale property. That is the transfer tax (Impuesto de Transmisiones Patrimoniales/ITP in Spanish). The amount you pay depends on the price of the house. It is less expensive when it is cheaper and more expensive when it is more expensive. Transfer tax depends on the location you are buying the property, and it can be around 8-14%.

Different types of land you can buy in Spain

Spain has an abundance of different landscapes, climates, and views, which means that you can easily find the type of property or plot of land for your needs. Here are some of the most common types of land in Spain:

Mountain land

Extremely steep or irregular plots that are difficult to access. You can find areas in the mountains that have been used for building but it is quite rare.

There aren’t many opportunities to buy land with a view over the sea since this type of property is sought after and is, therefore, very expensive.

Plots of land on the outskirts of big cities

Generally speaking, these are more affordable than central areas, but there is more building involved to make them developable. The construction process also takes longer because of local legislation, which forces you to follow stricter codes when building.

As far as purchasing plots of land are concerned, the most important thing is to consider that it is an investment and not just a purchase. You need to be sure of what you are buying. However, there are plenty of options available for any budget.

Different types of houses you can buy in Spain

There are also different properties you can buy in areas close to cities depending on the size you want and where you want it to be located. The following are some of the most popular:

Apartments

In most cases, this refers to an exclusive housing development where you can find both properties for sale or rent. There are many different types of apartments, and depending on the location, they will be more or less expensive. Some of these can be seen as bargain properties compared to other countries.

This is a property designed for one family only, which consists of at least two rooms plus other ancillary services such as bathrooms, etc. It can be found in the countryside, but it is rare.

Townhouses

It is an urban building with two or more floors with at least one wall shared with another property, usually in its courtyard or garden. They are discrete buildings, but they do have a lot of advantages. There is less land involved, so prices tend to be more affordable, and there is a greater chance of getting a roof terrace or balcony.

Villas

The traditional Spanish villa comes to mind when you hear the word “Spanish dream home”. They are generally detached houses with lots of space and gardens. There are also some villas in big cities like Madrid, Barcelona or Valencia (although they tend to be extremely expensive). Still, most villas are located on the coast, where they are mainly used as holiday homes.

Finca’s

Finca’s are a type of rural property found in Spain. They are typically used for agriculture or livestock farming, but can also be used for forestry. Fincas can be owned by individuals, families, or businesses. They are very interesting to buy, however, come specific issues on registration and use that need to be considered.

Castles

They are the most exclusive properties in Spain, and they tend to be located in rural areas with stunning views. Even though castles in ruins can sometimes be purchased, very few of them are in a condition that would allow you to live there.

The most expensive places to buy a home in Spain?

Property in Spain can get very exclusive and expensive. This is not just the case for houses but also if you are looking for land to build on. There are, however, some cities where property prices are particularly high.

Formentera

Formentera is so small that their property prices reflect on the island itself. If you are looking for a bigger house with stunning sea views, this is the place to go look.

Deià

It is a very picturesque mountainous region. The houses there are built on the hills and have beautiful views of the mountains.

Sant Joan de Labritja

Sant Joan de Labritja is located in Mallorca, which is one of the reasons why its so popular. It has a very similar landscape to the rest of the island, but it is more exclusive.

The town of Ibiza

This is the most exclusive place in Ibiza. It has stunning houses, some even with private beaches, golf courses, pools and spectacular beach views. It is considered a party island by many and a popular holiday destination.

The capital of Gipuzkoa

The houses there are very modern, and they have great outdoor spaces. The town of Bizkaia is a great place to live in if you want an exciting social life and a bustling city life.

San Sebastian

If you want to live in a big city with mountains and the sea nearby, this is a great place to go. It has great nightlife, great restaurants and is very multicultural.

Baqueira in Lleida

This is a great place for people who love winter sports and nature. It is located in the Pyrenees mountains, and it has ski resorts nearby.

Frequently asked questions:

What are common pitfalls when buying Spanish Property?

You need to be careful that you don’t fall for some common pitfalls when buying property in Spain.

- Understanding all the hidden costs

- Getting Illegal mortgages

- Buying a property that had an incorrect renovation

- Not reading your contract in detail

- Bad timing

- Lack of research in the area

- Not having a proper estate agent

Should you buy or rent Spanish property?

There is no correct answer to this question. It depends on your circumstances and financial situation. If you are looking to settle down in Spain and plan on living in the country for an extended period of time, then buying might be your best option. If you are only visiting for a few months and not plan on coming back, then renting is the best choice.

What is the NIE Number?

The NIE number is the identification code used for foreigners who are not residents of Spain. The number is required to open a bank account, apply for an identification card or passport, enrol your children in school etc. Getting one varies depending on whether you live in Andalusia, Catalonia, Madrid or other regions.

Can I get a Spanish Visa if I buy Spanish Property?

You can get a Spanish Golden Visa if you buy Spanish property that is worth more than 500,000 euros. The Golden Visa is a residency card that allows you to live and work in Spain. With this visa, you also get the ability to travel freely within the Schengen zone of EU countries.

When should I go on my viewing trip?

This of course is a personal decision and it depends on your individual circumstances. If you will be living in the area of your Spanish house or near enough, then going at any time would make sense. If not, we recommend going during the high season of your chosen town. That way, you get a feel for what it is like during peak times and can get a sense of what it’s like to live there. If you go during the off-season, it might look dead and not so exciting, affecting your decision to buy a house in Spain.

How long should my viewing trip last?

We recommend between 5-7 days to properly get a feel for the place. Of course, it depends on how much travelling you want to do but at least this time should be enough to visit the area, get an idea of what life is like there and decide whether or not to buy Spanish property.

Do I need to do a property surveyor for an inspection?

There is no need to hire a property surveyor for a viewing trip or an inspection. However, if the property looks sketchy, odd or in disrepair, it might be worth paying for one. But most importantly, if you are not perfectly comfortable with the house and aren’t sure of its state, that’s when hiring a surveyor makes the most sense.

Where do I start my property search?

There are many different sites where you can search for Spanish properties to buy, but the simplest and quickest way is with the help of a property agent. They will be able to show you the most suitable houses in your price range and make sure you don’t waste time viewing properties that are not worth buying.

Can I purchase a property from my home country?

Yes, you can! You can buy through SpainDesk with the Power of Attorney. With this, we will be able to take care of the property purchase in Spain for you. However, you will have to visit a Notary in your home country. Contact us, and we will explain this buying process to you.

When is the best time to buy Spanish Property?

The property market in Spain is on the up at the moment. This means if you plan to buy property in Spain, you are buying in a seller’s market. It might be worth waiting until the market calms down a little if you are in no rush. But if you want to buy right now, there is excellent potential for long term growth both in capital and rental income.

That being said, prices may also vary depending on the area and type of house you are looking to buy. You could say that some places will always be popular such as the Costa del Sol (i.e. Malaga, Marbella, Fuengirola etc.), Costa Blanca (i.e. Alicante, Torreviaja etc.), Costa Brava, (i.e. Palamos, Tossa de Mar, Blanes etc.) Balearic Islands (Mallorca, Ibiza etc.), and the Canary Islands (i.e. Tenerife, Gran Canaria etc.).

Can I get a Spanish mortgage?

It is possible to get a Spanish mortgage, but the requirements tend to be strict, and you will need to have a certain amount in savings. Remember that Spain also has 100% mortgages available, which means you can buy a house without paying any deposit. The thing about Spanish mortgages is that they vary significantly from bank to bank, so it might be worth looking around to find the best offer for you.

Do I need a Spanish bank Account to buy property in Spain?

You don’t need a Spanish bank account to buy property, but it can make your life easier. That way, you can manage all your Spanish accounts in one place.

A word from SpainDesk

Buying a property is a complicated venture, and it is recommended to get property experts involved. We can help you with everything through a power of attorney contract. This way, our lawyers will be fully protected during your purchase. We can provide this service to you and make acquiring your property in Spain easy and safe. Contact us for more information and get a free quote.

Get the help of a Property Lawyer in Spain

Disclaimer: Information on this page may be incomplete or outdated. Under no circumstances should the information listed be considered professional legal advice. We highly recommend seeking guidance from a legal expert if you lack extensive knowledge or experience dealing with any of the procedures outlined in these articles.