Selling property in Spain can be daunting, and you need to make many decisions that could save you money or cost you money. Next to this, it can take quite some time to sell your property. In this article, we will give you tips on how to go about selling your property in Spain.

How to sell a property in Spain in 20 steps

We go through each step you’re likely to take throughout the selling process, from beginning to end.

1. Decide whether or not you want to sell your business

There are various reasons why someone may choose to sell their property. Moving for employment, desire to downsize, or the need for a larger home are all possible motives. Another reason might be that you inherited a Spanish property and don’t live in Spain. You may also have bought a holiday home, intending to sell it at a later stage.

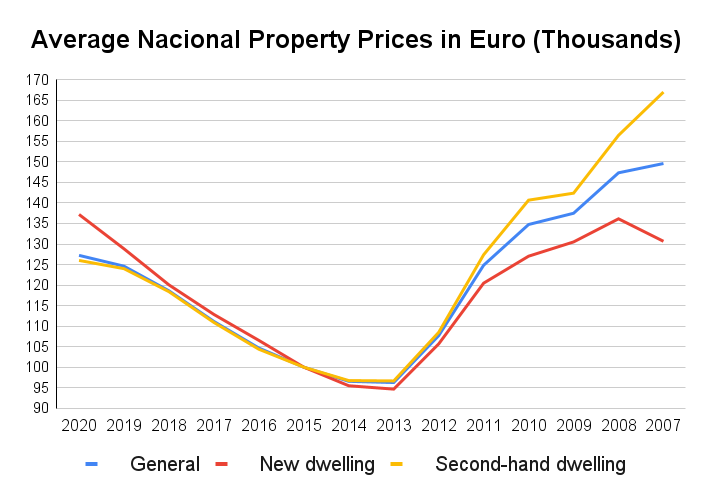

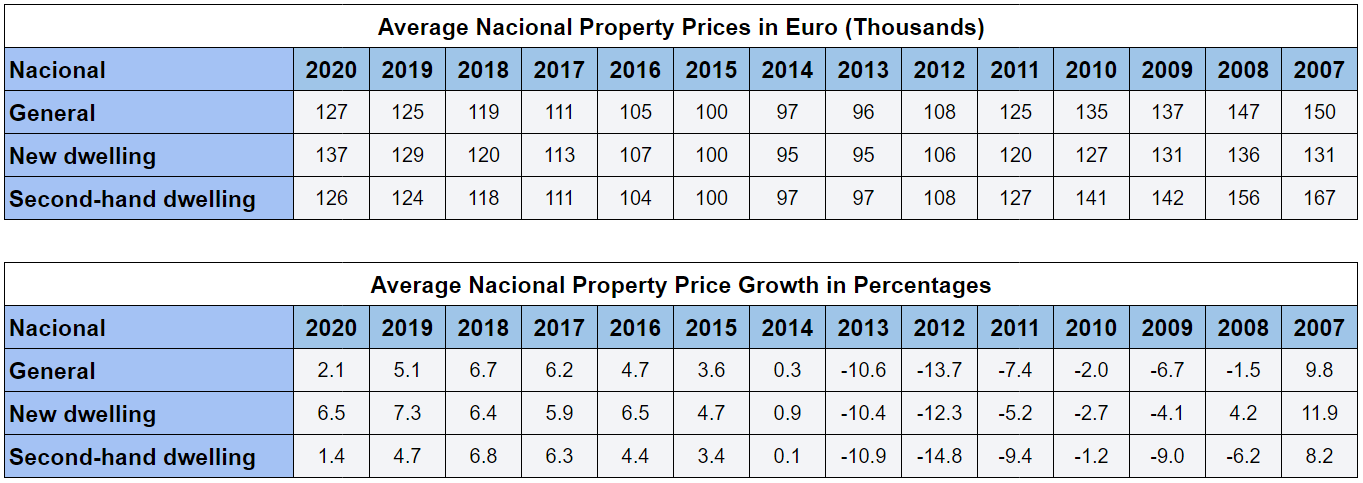

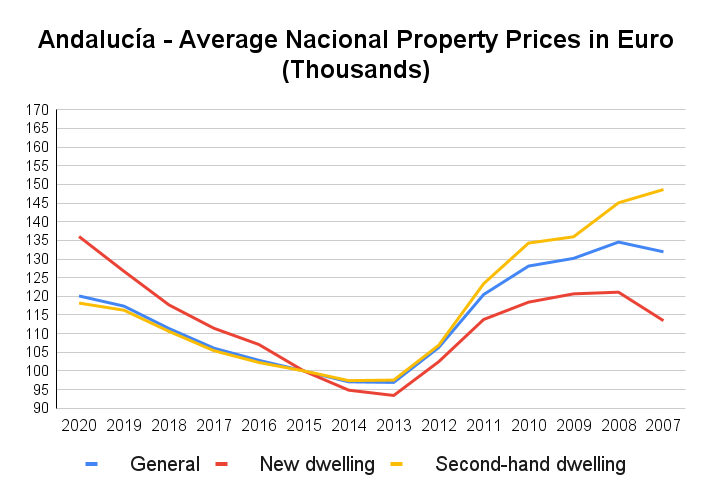

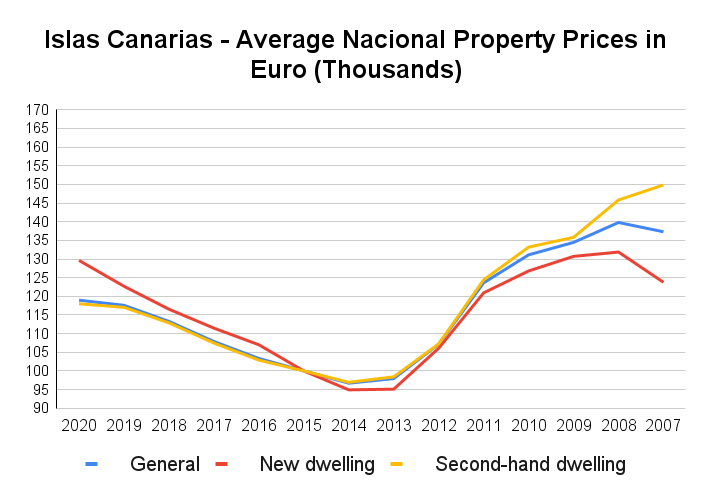

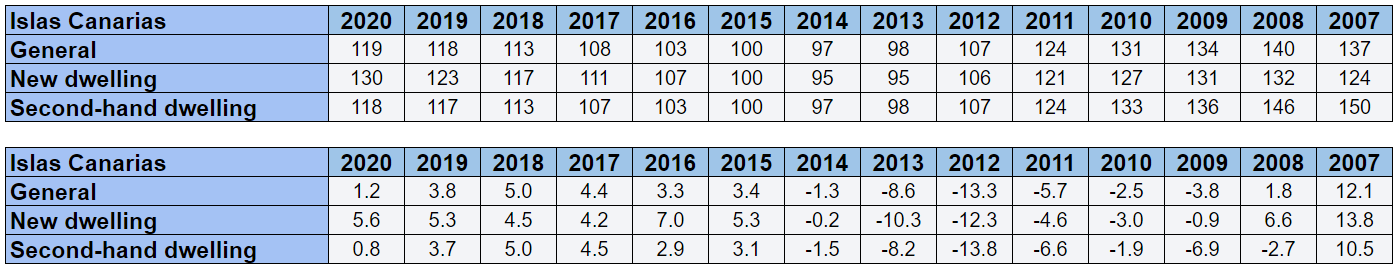

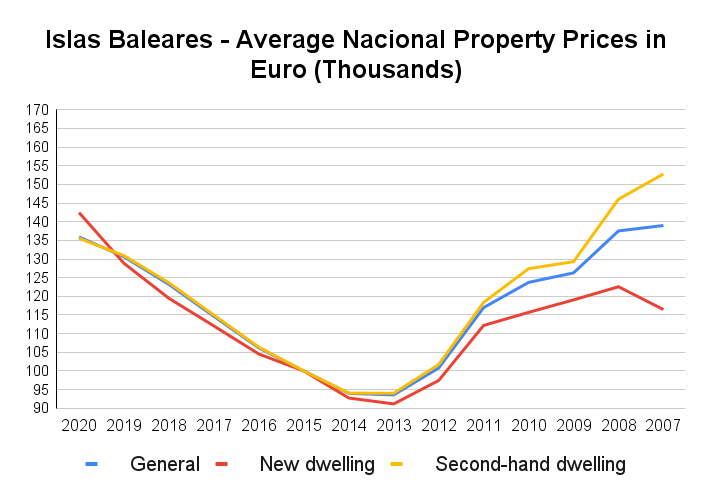

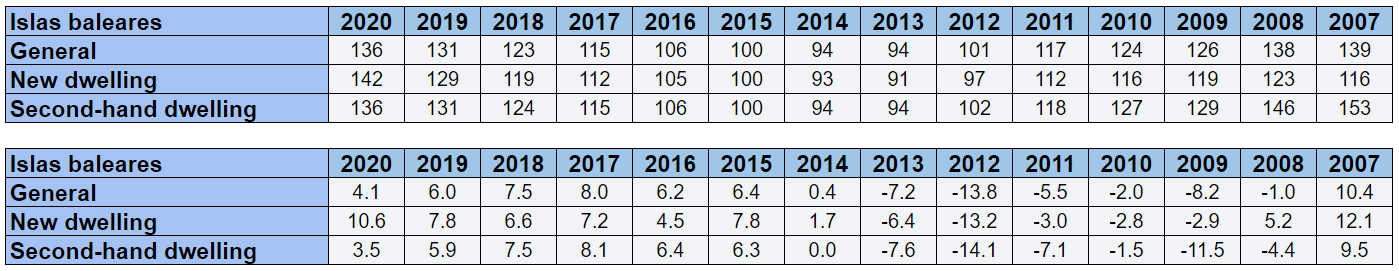

Reasons to change your mind are just as plentiful. Perhaps you can extend the property with a new room, rent out the property, buy a new one, or wait a bit because property prices are rising. However, timing the Spanish property market is complex and depends on the region.

In any case, if you are not happy with your current living situation, selling may be the best option for you.

2. Consider the financial situation

Take a look at your mortgage, debts, and other financial obligations associated with the Spanish property. You will need to factor these into your decision of whether or not to sell.

Also, consider what the property may be worth and how much you will need to sell it to break even. You may also want to consult a real estate professional who can tell you what your home is worth in the current market.

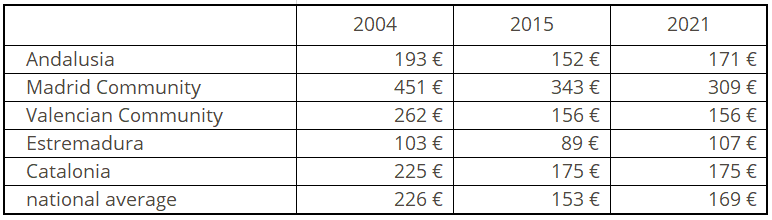

It is hard to estimate the property price without putting it on the market. However, there are some methods you can use to get a general idea. Look at similar properties in the area that have recently been sold, or look up the average price per square meter in your city.

If you plan on getting a new mortgage to purchase a new property, you will want to factor in how much you will get before selling your property.

3. Decide to rent a property or acquire a new one

Consider what you want to do after selling your property. If you are selling the place where you live, you need to consider where you will be moving to. Are you going to buy a new property, or will you rent an apartment or house?

Consider what location you want to live in, and get some options ready, so you don’t have to scramble to find a new place to live once your property is sold.

After selling your property, it is wise to rent a property for a bit until you find the perfect home to buy. This way, you won’t be rushed into a decision, and you can take your time looking for the right property. You will need to consider the moving expenses and whether or not it is worth it to move your belongings.

4. Choose a real estate agent to sell your property

Once you have decided to sell your property, you must choose a real estate agent. It is essential to do your research and find an agent who has experience selling properties in your area.

The agent will help you put your home on the market and advise increasing the chances of selling your property. The agent will also help you negotiate with buyers and give you an idea of what price to expect for your property.

Depending on the real estate agent, you may be able to find someone who speaks your language, and this can be helpful, especially if you are not comfortable with the Spanish language. Usually, an estate agent will charge you a commission of 3% when your property is sold, and this percentage is calculated towards the property buyer.

You can also try to sell your house by yourself, but this is not always easy. It can be time consuming, and you will need to do your marketing. You will also be responsible for negotiating with buyers and drawing up the contract. If you are not comfortable with this, it may be best to hire an agent.

5. Obtain an Energy Performance Certificate

You must obtain an Energy Performance Certificate to sell your Spanish property. This certificate rates the energy efficiency of your property on a scale from A to G.

The certificate is valid for ten years and can be obtained from a certified professional. The cost of the certificate will depend on the size of your property.

6. Decide the price of the property you are selling

After you have obtained your Energy Performance Certificate, you will need to decide how much you want to sell your property for. This is where you will need to consider your mortgage, debts, and other financial obligations associated with the property. Contact your bank about this.

You will also need to consider the current market value of your property. Look at similar properties in your area that have recently been sold, or look up the average price per square meter in your city.

Most buyers will try to negotiate a lower price than what is listed on the market, so it is essential to buffer negotiations.

Sometimes multiple estate agents will appraise your property for free to get your business. It is essential to get various opinions, as the appraisals can vary greatly. If you are set on selling your property for a high price, the agent will need to be willing to list your property for that price. So talk about this with your agent before signing a contract.

7. Prepare to sell your Spanish property

Once you have decided on a price, the next step is to prepare your property to be put on the market. This includes staging your home, fixing any damages, and putting together a list of features that make your property stand out. Fixing damages can be expensive, but it is worth it to make your home look its best because it can increase the price significantly.

Next to this, you will need excellent photographs taken of your property. The photos need to be high quality and show your property in its best light to make an excellent first impression.

The real estate agent will help you with this process and put together a listing for your property. This includes all the essential details about your home, such as the number of bedrooms and bathrooms, the size of the property, and the price.

8. Market your property

Once your property is ready, the next step is to market it. This includes advertising your home in local newspapers and online, as well as creating a listing for your property on real estate websites.

The estate agent will do most of this for you, but it is essential to keep in mind that the more exposure your property gets, the better. It doesn’t harm to do some extra advertising on your own as well, since you are the one who stands to profit from the sale the most.

9. Use a property lawyer solicitor to assist you in the sale

When you have an interested buyer, the next step is to negotiate a sale price and sign a contract. This is where a property lawyer comes in.

Conveyancing solicitors are legal professionals who specialise in property law. They will help you review the contract, make sure that everything is in order, and represent you in the sale.

They can also assist you with the transfer of ownership and paying taxes, including a tax rebate. The tax rebate is based on the costs of acquisition and sales, so you can get a free lawyer to assist you in selling your Spanish property.

10. Choose a notary

A notary (notario) is necessary to sell any property in Spain. The notary is a public official who witnesses the signing of the contract and ensures that all legal requirements are met.

The notary will also draw up the deed of sale (escritura de venta), which is the document that transfers ownership of the property from the seller to the buyer.

The buyer pays the notary’s fees, and they vary depending on the property’s value. It is important to choose a notary registered with the Spanish Notaries Association (Colegio de Notarios de España), as this will ensure that they are qualified to carry out the sale.

If you are working with a lawyer, the lawyer can help you choose a notary. If you create a power of attorney for the lawyer, he can sign on your behalf to transfer the property to the buyer.

11. Prepare the documentation

When you are selling a property in Spain, you will need to prepare a number of documents. These include:

- Title deed: the title deed or escritura de propiedad is the document that proves that you own the property.

- The cadastral certificate (certificado cadastral): This shows the official measurements of the property and is used to calculate

- Copies of utility bills: You will need to provide copies of the last three months of utility bills, as well as proof that you have paid any outstanding balances.

- The energy performance certificate: (certificado de eficiencia energética): This certificate rates the property’s energy efficiency and is required by law.

- IBI receipts: The IBI receipts or Impuesto sobre Bienes Inmuebles are the Receipts for local municipal tax. The buyer will want to see these to ensure no outstanding taxes. If there is still debt on the property, they may want to be discounted. IBI receipts for the last four years is necessary.

- NIE, Residency card, and Passport: To process the property sale, the notary will need to see copies of your passport and residency card (if applicable, as well as your NIE number (tax identification number).

- Property inventory: To make the sale concrete, you should have a complete inventory of all furniture, appliances, and fixtures included in the sale. This will help avoid any confusion or disputes after the sale is final.

- Community statutes: If the property is part of a community of owners, you will need to provide a copy of the community statutes. This document sets out the rules and regulations that govern the community.

- Fill out a buyer’s questionnaire: upon selling, a buyer will want to know what their buying out of. Specific questions about the property will be asked, and it is advisable to answer truthfully as some buyers may rescind the offer if discrepancies are found.

12. Accept an offer when it is made to you

Once you have found a buyer interested in your property, they will make an offer to you. This offer will be in the form of a contract, which will outline the terms of the sale.

If you are not happy with the offer, you can negotiate with the buyer to try and reach an agreement. Once an agreement has been reached, you will both need to sign the contract.

13. Negotiate the contract’s terms

Once you have verbally accepted the offer from the buyer, you will need to negotiate the terms of the contract. This includes setting a price for the property and agreeing on a date for sale to be finalised.

The contract should also state who is responsible for any outstanding debts on the property and whether or not the buyer is taking over this responsibility. It is also important to set out the date the buyer must take possession of the property.

Other aspects of the contract are

- The period between the exchange of the contract and completion of the sale.

- What is included in the inventory of the property?

- Any discounts due to issues with the property (debt, lack of certificates, etc.).

Your lawyer should review the contract to ensure that all of your rights and interests are protected.

14. Settle the contracts

Exchange the contract and sign it with the buyer. This contract is binding, and once it is signed, you are both obligated to complete the sale.

The buyer will usually pay a deposit at this stage, generally 10% of the purchase price. This deposit is held in escrow until the completion of the sale.

As the seller pulls out of the sale, you may lose this deposit. If the buyer pulls out, they may be able to get their deposit back, depending on the contract terms. If necessary, your lawyer can help negotiate better terms for you or negotiate to both pull-out.

15. Move out of the property

Once the sale is completed and the keys have been handed over to the buyer, you will need to move out of the property. Ensure that you leave the property in a clean and tidy condition and remove all of your personal belongings.

As in the contract, the property needs to be in the state that you have agreed on with the buyer. The buyer and the buyer’s lawyer will do a final inspection of the property before completion to ensure that everything is as it should be.

The buyer’s lawyer will also check that all relevant paperwork (title deeds, community statutes, bills and receipts) is in order and transferred to the buyer’s name. They will check that all of the money has been transferred from the buyer to you and everything is as the contract states. Buying property in Spain also entails various other aspects.

16. Finalise the sale

When you hand over the keys to the property and remove all of your belongings, the sale is finalised. The buyer will receive the title deed to the property, and you will receive the money from the sale in your bank account.

At the notary’s office, the buyer will sign a declaration of purchase, and you will sign a declaration of sale. In the Spanish land registry, the buyer will enter their name as the property’s new owner.

This process in the Spanish land registry can take some time, depending on the complexity of the sale. Your lawyer will keep you updated on the progress of the sale and will help to finalise all of the paperwork.

17. Paying taxes on the sale

You will need to pay capital gains tax on the sale of the property. The amount of tax you will need to pay will depend on how long you have owned the property, as well as your tax situation.

You may also be liable for other taxes, such as local property taxes and stamp duty. Your lawyer will advise you on what taxes you need to pay.

They can assist you with questions such as “how much profit do you have?” and “how much tax do you need to pay?” Tax implications of the sale can be complex, especially if you don’t speak the language. Your lawyer will be able to guide you through the process and ensure that you pay the correct amount of tax.

After selling, you may be liable for a tax rebate of 3%. Costs for the acquisition of the property and the sales of the property, and other associated costs can be deducted from the tax payable. Ask your lawyer to get the rebate for you since you will need to submit the paperwork.

18. Settle the mortgage

The mortgage company will have given you and your lawyer a precise redemption amount (unpaid balance) for your mortgage on the day of completion. This is the amount of money you need to pay back to the bank for the mortgage to be paid off.

Once the mortgage is paid off, you will need to provide the bank with a copy of the title deed, as well as a copy of the declaration of sale from the notary’s office. The bank will then update their records, and you will no longer be liable for the mortgage payments.

19. Settle the lawyer and estate agent

The final step is to settle your lawyer’s and estate agent’s fees. Your lawyer, notary, and the estate agent will provide you with an invoice for their services, which you will need to pay. If you have given a power of attorney to your lawyer, they will be able to settle the fees on your behalf or get you the receipts.

Property taxes when selling a property in Spain

The Spanish tax office will want its property tax part, so an important aspect of selling a property in Spain is determining which taxes you will need to pay.

Capital gains tax

As a seller, you will have to pay capital gains tax to the federal government on the profits from the sale. The capital gains tax is either 19% for people not from the EU/EEA or 24% for people not from Europe. If you are a resident of Spain, you will pay between 19% and 23%.

- 19% for the first 6.000€

- 21% from 6.000€ to 50.000€

- 23% from 50.000€ onwards

The buyer must be a Spanish resident to avoid the 24% rate in some cases.

Plusvalía tax

The capital gains tax and plusvalía tax are two separate taxes. The municipality receives the plusvalía payment. The “plusvalía tax” or “plusvalía municipal” has changed in 2021. In general, the more significant the increase to the official cadastral value during their ownership, the more tax the tax will be.

For the plusvalia municipal, there are two options. You pay duty on the difference between the purchase and sales prices or use an equation based on the cadastral.

Although the rates will differ from location to location, they range between 0.08% and 0.45%. If there is no gain in the value of the land, no tax will be charged.

When a property trades hands, the seller usually pays the tax, but the beneficiary will see the bill if it is a gift or inherited property. If the seller is in a foreign country, the buyer will also have to pay the withholding tax.

Frequently asked questions

Will I need a lawyer to sell my property in Spain?

If you sell property in Spain, you must attend the closing. If you can’t be there, a lawyer can create a power of attorney so someone else (like your lawyer) can handle the transaction.

What costs are involved in selling a property in Spain?

Costs of selling property in Spain include the agent’s commission (3-6%), legal fees (1-1.5% + VAT), plusvalía tax, and capital gains tax.

Do you have to pay capital gains when you sell your house in Spain?

You will only have to pay capital gains tax if you make a profit on the sale of your property.