When it comes to estate planning in Spain, there are a lot of things to think about, but the most important one is the topic of making a Will in Spain. This document ensures that your wishes are carried out after you die. In Spain, there are specific Inheritance Laws that you need to know about when making the Will. If you’re thinking about creating one in this country, read on for more information.

What is a Will?

To get a better grasp on what you need to do when making a Spanish Will (or Last Testament), it’s important to first understand what a Will is. A Will is a formal document that states your wishes regarding the disposition of your assets after your death. When you have assets in multiple countries, you can also use a Foreign Will for your Spanish assets. However, it is better to also make a Spanish will for your Spanish assets.

The Spanish Will / Spanish Testament is the legal document that will say what should happen with your assets following the Spanish Inheritance Law.

To make a valid will, a testator (the person that is making the Spanish Will) has to sign the Spanish Will in the presence of two witnesses. The heirs need to pay Spanish Inheritance Tax over their new assets in Spain. The person that inherits your property is called the Heredero. The Spanish Will is kept safe in the Registry of Wills (Registro General de Actos de Ultima Voluntad), and the notary where it was signed.

The reason to make a Spanish Will

Inheritance Law in Spain is based on the principle of intestate succession. This means that if you don’t make a Will, your assets in Spain will be distributed according to specific rules set out by the government. So it’s important to understand these rules before you decide whether or not to make a Will.

The first thing you need to know is that, in Spain, there is a hierarchy of heirs. The closest relatives will inherit your assets first, and only if they don’t exist will more distant relatives inherit. This hierarchy is as follows: children and grandchildren, parents, spouse, siblings, nieces and nephews, more distant relatives, and the state. As you can imagine there might be several reasons why you might want to create a Spanish Will. These could include:

- You want to ensure that your Spanish assets are distributed in a different sequence than the Inheritance Law

- You want to leave something to someone who is not in the hierarchy of heirs, such as a friend or charity

- You want to disinherit someone who would otherwise inherit under the intestate rules, such as a child from a previous

Get help with your Inheritance in Spain from a professional. Contact SpainDesk

Making a Spanish Will and the Spanish Inheritance Tax

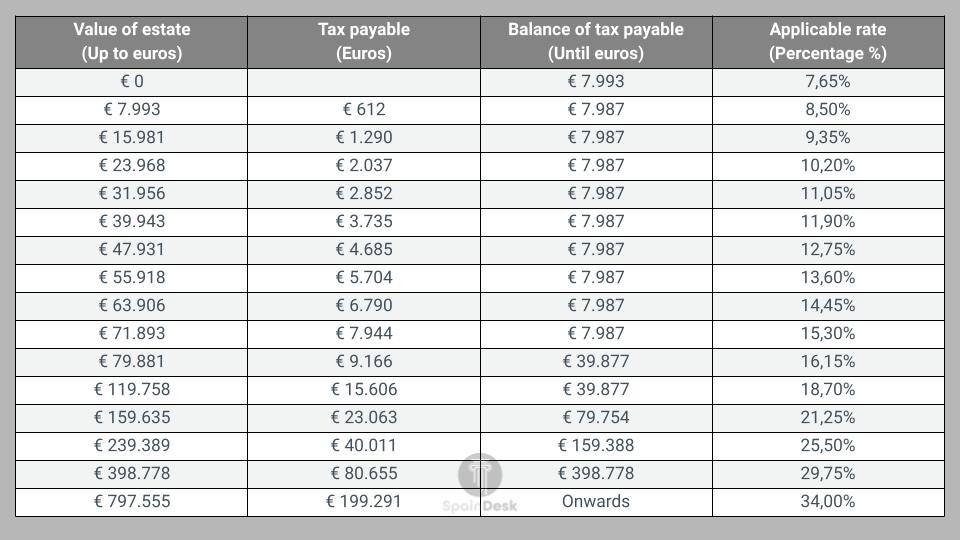

There is a Spanish Inheritance Tax that must be paid on Spanish assets that are passed down to the beneficiaries. The inheritance tax rate varies depending on the relationship between the beneficiary and the deceased, the value of the assets, and the wealth of the beneficiaries. It is important to be aware of these taxes when making a will, as they can have a significant impact on how much the total stake beneficiaries ultimately receive.

Proper estate planning to divide your Spanish Assets is therefore recommended. A Spanish Law Firm specializing in Spanish Succession Law will be able to help you with this. Expert legal advice can save the beneficiaries a lot of money. Moreover, if you only choose to only use a Foreign Will in Spain, the Inheritance Tax payable over the Spanish assets may cause a higher total inheritance tax compared to creating a separate Spanish Will. In this case, legal and notary fees will be worth your while.

The Law of Obligatory Heirs in Spain

When creating a Will in Spain, it is important to understand the concept of the Law of Obligatory Heirs. This refers to the spouse and descendant who are legally entitled to a portion of the estate, regardless of what the Will says.

As a result, it is important to consider the potential claims of obligatory heirs when crafting a Spanish Will. Otherwise, there is a risk that the wishes expressed in the Will may not be carried out. In addition, it is worth noting that the rules regarding obligatory heirs can vary from one region to another. For this reason, it is always advisable to seek legal advice when creating a Spanish will.

In essence, the Law of obligated heirs states that the estate is divided into three equal parts.

- First part: A third of the assets may be distributed based on the testator’s complete will. That is, it may be inherited by anybody or an organization in the form and amount that the deceased specified.

- Second part: This part of the inheritance is referred to as “improvement.” This section of the property must be conferred exclusively on the heirs. However, it may be divided according to the testator’s will. This implies that a single person can inherit the entire percentage.

- Third part: The last portion does not need to be mentioned in the Will because it is distributed equally among the heirs who agree to take it.

The Law of Obligated Heirs protects the people who have the right to a portion of the estate, regardless of what the Will says. However, some autonomous regions have different rules (some give more freedoms). Speak with an Inheritance Lawyer to understand the rules in your area.

Will and your Residency Status in Spain

When you are creating your Spanish last testament you need to consider whether you are a resident or non-resident in Spain. Residents will have their worldwide assets subject to the Spanish Inheritance Tax, whereas non-residents will only be taxed on assets located in Spain.

If you are a resident of Spain, your Will must comply with Spanish law, even if your assets are located outside of Spain.

If you are from the EU. In certain conditions, you can state in your Will that you want to use the Inheritance Tax rules of your home country. Speak with an Inheritance Lawyer to determine if this is the right option for you.

What can you put inside the Will?

Making a Spanish Will gives you the opportunity to express your final wishes. There are several options when it comes to what you can put in your will. We have noted the most common questions answered below:

- Who will receive your assets?

- What form they will receive them?

- When they will receive them?

- How your debts and taxes will be paid?

- Who will care for children and manage their Inheritance?

- What children are recognized?

- What are the wishes for the funeral and burial?

You can also name someone to be the executor (Albacea) of your estate. This person will make sure that your final wishes are carried out according to the terms set forth in your Will.

The Types of Wills in Spain

When you have established what you would like your final wishes to be, you will need to choose the type of Spanish Will that best suits your needs. In Spain, there are several types, the three most common are:

The Open Will

The Open Will (Testamento Abierto) is the most common type of Will in Spain. It’s also the easiest and quickest to make. You can make the Open Will at any time without having to go through a Notary. All you need to do is write out your wishes, sign the document in front of two witnesses and ensure that it’s filed with the Registry of Wills in your local area. Keep in mind that the Open will needs to be valid according to the Spanish Inheritance Law.

The Closed Will

The Closed Will (Testamento Cerrado) type of Will is slightly more complicated to make as it should be written by an Inheritance Lawyer. It’s a good option if you have more complex wishes or a large estate. The closed will must be signed by the Notary and put into a legally binding document. Once it’s signed by both parties, it’s then sealed and kept with the Registry of Wills. The Will is not opened until after your death.

The Holographic Will

The Holographic Will (Testamento ológrafo) is the least common type of Will in Spain and is only practical in certain situations. It’s handwritten or orally communicated. There are five witnesses required, and they need to be verified by a judge upon death. A Notary is not required for this type of Will. The downside of a Holographic Will may be that it will take longer, and can make the process complicated.

Typical Pitfalls When Making a Will in Spain

It’s important to be aware of the potential pitfalls when making your Will in Spain. Below, we have listed some common mistakes that people make:

Not having a Will at all

If you don’t have a Will in place, your estate will be subject to the laws of intestacy. This means that your assets will be distributed according to the rules set out by the Spanish government. This may not be what you want and could result in your loved ones not receiving what you intended for them to have.

Not updating your Will

If you don’t update your Will, it may not reflect your current wishes. For example, you may have got married, had children or bought a new property since you made your Will. If you don’t update it, these changes will not be taken into account.

Not being clear enough

It’s important to be as specific as possible when making your Will. This will avoid any confusion or ambiguity about what you want to happen to your assets.

Leaving property behind to someone that doesn’t have any savings

If you leave property to someone who doesn’t have any savings, they may not be able to afford the Inheritance Tax. This could result in them having to sell the property in order to pay the tax.

Not registering your Will

You must register your Will with the Registry of Wills in order for it to be valid. If you don’t do this, your Will may not be taken into account when distributing your assets.

Having too many beneficiaries

If you have too many beneficiaries, it can make your Will more complicated and difficult to administer. This could result in delays and disputes after your death.

Making the Will illegal

You must ensure that your Will is in line with the Spanish Inheritance Law. If it’s not, it could be declared invalid.

Putting a charity that doesn’t have a Spanish NIE

If you include a charity in your Will, you must ensure that it has a Spanish NIE number. Otherwise, they need to apply for a NIE number, to pay the Inheritance Tax, and they may not want to do that.

Not keeping your will up to date with changes in the law

The Spanish Inheritance Law changes from time to time. If your Will is not updated to reflect these changes, it could be declared invalid.

When is a Spanish Will valid?

A Will is only valid when the testator dies. If the testator changes their mind about any of the details in the Will, they can simply create a new one that supersedes the old one. For Will to be valid at a Notary:

- You must be at least 18 years old

- Make it on your own if you wish

- Be of mental capacity

- Make it in writing

- Written in Spanish

- Signed at a Notary in the presence of two adults

Next to this, it’s important to note that, in Spain, the Will cannot be made orally. It must be written down and signed in order to be valid.

Frequently Asked Questions

Below you can find some frequently asked questions about making a Will in Spain.

Do I need to have my Will professionally translated?

If your Will is written in a language other than Spanish, it must be professionally translated into Spanish before it can be registered. Otherwise, it will not be considered valid. The translation must be done by a sworn translator who is registered with the Spanish Ministry of Foreign Affairs.

Can I revoke my Will?

Yes, you can revoke your Will at any time. To do so, you simply need to create a new Will that states that it revokes all previous Wills. This new Will must then be signed and registered in the same way as any other Will.

Can I make changes to my Will without making a new one?

Yes, you can make changes to your Will without making a new one. This is known as a codicil. A codicil is a document that supplements, amends, or revokes parts of an existing Will. It must be signed and registered in the same way as any other Will.

How much does it cost to make a Will in Spain?

The cost of making a Will in Spain varies depending on the complexity of the document and the lawyer you use. However, you can expect to pay between €200 and €1,000. If you have a simple Will, it is possible to find a lawyer who Will charge a fixed fee. However, if your Spanish Will is more complex, you may need to pay an hourly rate.

Can I make a Will online in Spain?

While it is possible to create a Spanish Will online, there are certain legal requirements that must be met in order for the document to be valid. First, the will must be signed by two witnesses who are over the age of 18. In addition, the testator must sign the document in front of a Notary Public. Once these requirements have been met, the will can be registered with the registry office in Spain. While an online will can be a convenient way to create this important document, it is important to make sure that all of the legal requirements are met in order to ensure that the document is legally binding. We suggest speaking to our Inheritance lawyer in Spain about creating a Will online.

Can you write your own Will in Spain?

In Spain, you can write your own Will without the aid of a lawyer or Notary Public. However, there are certain requirements that must be met in order for the document to be legally binding. If the Spanish Inheritance Law is met, then your Testament is legally binding in Spain. Of course, to make a Spanish Will we recommend consulting with a Spanish Inheritance attorney to ensure that your Spanish Will meets all of the requirements and that your wishes are properly conveyed.

Create a Spanish Will with the help of our Inheritance Lawyer in Spain

Making a Spanish Will is an important decision. If you need legal advice on creating a Spanish Will, our team of experienced Inheritance Lawyers in Spain can help. We will work with you to understand your wishes and ensure that your Will meets all legal requirements. Contact our Spanish lawyer for assistance.

Get help with your Inheritance in Spain from a professional

Disclaimer: Information on this page may be incomplete or outdated. Under no circumstances should the information listed be considered professional legal or financial advice. We highly recommend seeking guidance from a legal or financial expert if you lack extensive knowledge or experience dealing with any of the procedures outlined in these articles.