As in most developed economies, Spain supports its welfare and social services system thanks to taxes. Spanish residents, non-residents, and citizens enjoy numerous social programs that taxpayers pay for through various taxes. The Spanish tax system pays for the health and education system, social assistance to low-income people, unemployment insurance, commonly called “unemployment pay”, the retirement pension system, citizen security, and other public services.

The Spanish tax rates that residents and non-residents pay are different, and understanding precisely the difference will allow you to manage your savings and income more efficiently. You can distinguish taxes by direct taxes and indirect taxes.

The main direct taxes in Spain

Direct tax is an income or property tax paid directly to the government by the taxpayer. Among the direct taxes in Spain are:

- Personal income tax: the personal income tax is taxed based on the taxpayer’s income. If you are a tax non-resident, the government will only tax Spanish income.

- Corporate income tax (IS): Companies need to pay a corporate income tax (a business tax).

- Wealth tax: The local Spanish tax office levies taxes on people’s wealth. However, some autonomous regions in the country completely discount it. If the government taxes your wealth, you need to pay tax on your assets minus the debts.

- Inheritance and gift tax: When a succession happens, and you receive an amount of money, you will have to pay inheritance tax over this income.

The main indirect taxes in Spain

An indirect tax levied on transactions (sales) of goods and services. Among the indirect taxes in Spain are:

- Value Added Tax (IVA): The value-added tax is the most important indirect tax, and it taxes the consumption of goods and services by individuals and companies. It is well known because it affects us all in our day-to-day life, and it is very little loved since it makes products more expensive, an issue that hinders the competitiveness of the seller and the purchasing power of the buyer. Some products have a lower IVA to minimise this negative impact, as they are considered essential products. There are three types of IVA at 21%, 10%, and 4%.

- ITPAJD: Three groups fall under these taxes, which are asset transfers (related to property tax), corporate transactions (related to the incorporation of companies), and documented legal acts (related to notarising commercial and administrative documents).

Get taxes done more quickly and efficiently with our tax services in Spain

Are you a tax resident or a tax non-resident?

It is essential to determine if you are a tax resident or non-resident in Spain. Whether you are a resident for tax purposes or not will determine the height of the taxes you will have to pay.

You will be regarded as a tax resident if you fulfil one of the three following conditions.

- When you are a resident of Spain for more than 183 days each calendar year, from January to December (the days need not be consecutive to count).

- When you have a dominant professional tie to the country, which means you do a job or have employment in Spain. This scenario is typical for someone who works for a Spanish company for part of the year but spends most of his time travelling and meeting clients worldwide.

- Your spouse or children reside in Spain.

This distinction only applies to tax concerns and has nothing to do with the residence permit, allowing you to reside in the nation lawfully. This implies that you may have a residence permit in Spain, but you could be classified as a non-resident for tax purposes if you do not fulfil the criteria.

The personal income tax (IRPF) for tax residents in Spain

The personal income tax (PIT) for Spanish tax residents, also known as the Impuesto sobre la Renta de las Personas Físicas (IRPF), is generally on their worldwide income regardless of the earning location. The PIT is a progressive income tax. Who makes more will pay more.

The calculation for income tax for tax residents is with the general income (Renta General) and savings income (Renta del Ahorro). The personal income includes:

- Payroll and benefits.

- Gains on assets via another party, such as lottery winnings.

- Interest and other revenue generated.

- Dividends and other income from company investments.

- Revenue generated from capitalisation transactions and life and disability income insurance.

- Capital gains from transfers of assets.

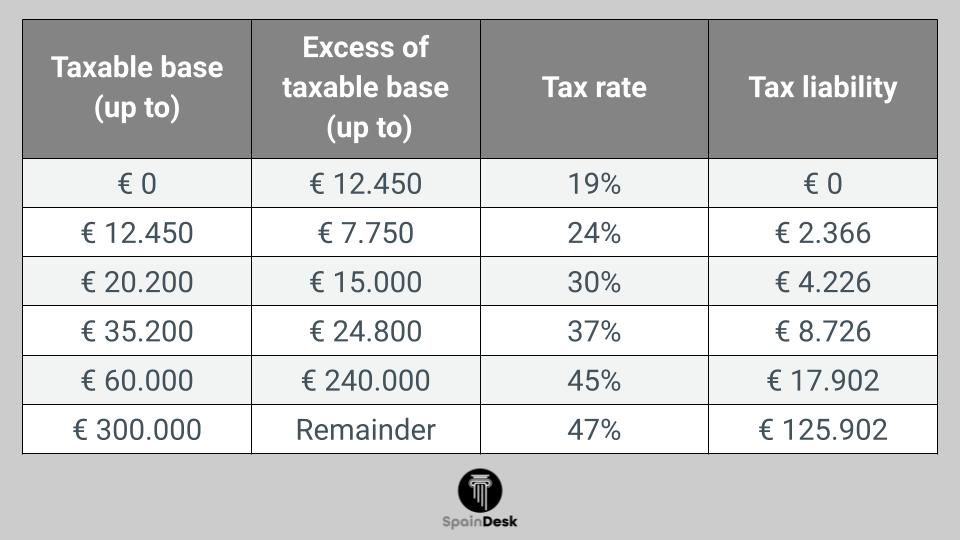

The progressive income tax for tax-residents in Spain

Below you can find an idea of the progressive income tax for tax residents in Spain. You should always calculate the actual personal income tax rates by looking at the autonomous region in Spain where you are a tax resident.

| Taxable base (up to) |

Tax liability |

Excess of taxable base (up to) |

Tax rate |

| €0 |

€0 |

€12,450 |

19% |

| €12,450 |

€2,365.50 |

€7,750 |

24% |

| €20,200 |

€4,225.50 |

€15,000 |

30% |

| €35,200 |

€8,725.50 |

€24,800 |

37% |

| €60,000 |

€17,901.50 |

€240,000 |

45% |

| €300,000 |

€125,901.50 |

Remainder |

47% |

Income tax brackets differ a lot in the different autonomous regions. For example, Madrid has a lower income tax compared to Catalonia.

The income tax has deductions

The Spanish income tax has several deductions. These deductions will help you to pay fewer income taxes in Spain. Make sure you know which of these exemptions apply to you, and get the help of a tax advisor if you are not sure. That way, you don’t pay more Spanish income tax than necessary. Some of these allowances are:

A tax resident in Spain will get an allowance based on their age. This tax allowance will increase as people age.

- under the age of 65: €5,550

- age 65: €6,700

- age 75: €8,100

In addition, the tax resident has a deduction for each dependent child. If you have children under 25 living with you, you can claim an additional allowance of:

- €2,400 for the first child

- €2,700 for the second

- €4,000 for the third

- €4,500 for the fourth

- An additional allowance of €2,800 for each child under three years

There are also income tax deductions in Spain for:

- Payments into the Spanish social security system and pensions

- Charity donations

- Certain costs for purchasing and renovating a home

- Dependents who are disabled to a certain degree.

There is no PIT on wage income earned by tax residents in Spain but who perform their business activities entirely outside the country. However, there is a maximum limit of up to 60,100 euro’s. In general, you can apply this if:

- The work is physically outside Spain.

- The work is for a non-resident Spanish company or entity.

- In the nation where the employee performs the work, a similar or identical tax as the Spanish PIT is used. The country where the services is not a tax haven. The government has a tax treaty to avoid double taxation, with an exchange of information clause.

Income tax in Spain for non-residents

In the same way that the resident population in Spain is subject to personal income tax, non-residents need to pay the Non-Resident Income Tax, also known as the Impuesto sobre la Renta de No Residentes (IRNR). This declaration, which depends on the type of income and country of residence, applies tax rates between 19% or 24%. This includes income obtained in Spain through economic activities, income from real estate capital, possession of a second residence, and pensions.

In some cases, you must pay taxes derived from activities in Spain and in your country of residence. Spain has signed double taxation agreements with several countries, the list of which is published by the Tax Agency, and this double taxation agreement will determine where you will pay taxes.

In addition to the IRNR, other taxes for non-residents can be the Real Estate Tax (IBI), the Tax on Patrimonial Transmissions (ITP), and the Wealth Tax (IP) of the assets that are in Spain and have a value of above 700,000 euros.

Non-resident tax will be due if you are not a fiscal resident but have a property or other assets in Spain that generate income. This non-resident tax is on your assets and firms in which you are a shareholder.

This Spanish tax will be levied at 24% if you are a non-EU citizen and 19% if you are from the European Union.

Taxes on rental income in Spain

If you profit from renting properties in Spain, you need to pay taxes on this income.

Non-residents are subject to the flat non-resident Income Tax (IRNR, Impuesto sobre la Renta de personas No Residentes) which is a flat tax rate of 19%. If you are not from the EU or EAA countries, the flat tax rate is 24%.

You can find more information about the rental income tax in Spain in our article.

Wealth tax in Spain

The Spanish wealth tax, often known as the ‘Impuesto sobre el Patrimonio,’ is a yearly levy on people and families in Spain with substantial assets.

Wealth tax for a tax resident in Spain

The wealth tax for tax residents in Spain takes all the person’s assets into account, and you can calculate by subtracting a person’s assets minus their debts. Tax residents will generally pay wealth tax in Spain on their worldwide assets.

In general, you will pay taxes on wealth valued above €700,000. But this can vary from region to region. For example, Catalonian residents will pay tax on assets above €500,000, while people in Madrid are don’t pay wealth tax at all.

The national progressive wealth tax in Spain

The national wealth tax in Spain is for residents who reside in an autonomous region that has not set a wealth tax rate, which is:

| Taxable base |

Full fee |

Rest base payable |

Applicable rate |

| 0,00 € |

0,00 € |

167.129,45 € |

0,2 % |

| 167.129,45 € |

334,26 € |

167.123,43 € |

0,3 % |

| 334.252,88 € |

835,63 € |

334.246,87 € |

0,5 % |

| 668.499,75 € |

2.506,86 € |

668.499,76 € |

0,9 % |

| 1.336.999,51 € |

8.523,36 € |

1.336.999,50 € |

1,3 % |

| 2.673.999,01 € |

25.904,35 € |

2.673.999,02 € |

1,7 % |

| 5.347.998,03 € |

71.362,33 € |

5.347.998,03 € |

2,1 % |

| 10.695.996,06 € |

183.670,29 € |

Onwards |

3,5 % |

Wealth tax deductions

- Primary home in Spain (up to 300,000 EURO)

- General household contents (except any items listed above)

- Pension rights

- A range of small business assets and family company holdings

- Bonds for Life Assurance

Wealth tax for non-residents in Spain

If you’re living in Spain as a non-resident for tax purposes, you will pay tax on your assets within the country that are valued at over €700,000. This means that if all the rest of your possessions are located outside of Spain, they are not subject to wealth tax.

Non-residents pay wealth tax on a national level. Non-resident wealth tax rates have increased since prior years, ranging from 0.2% to 3.5%. The top tax bracket begins at around 10 million euros.

Look at our article on Spanish wealth tax if you would like to learn more about it. We can also answer your questions on Spanish wealth tax through consultation.

Inheritance and Gift Tax in Spain

When a succession happens and people receive an amount of money, this is considered by the tax agency as obtaining an income, so it fits perfectly into the name of direct taxes. The most common case in which inheritance tax is applied is when an inheritance is received. The most important points are:

- Because there is no concept of a person’s “estate” in Spain, all beneficiaries are charged inheritance tax in some manner or another.

- The Spanish inheritance law states that two-thirds of your belongings will be given to your children automatically upon your death.

- If the assets are outside of Spain and the beneficiary is not a resident in Spain, no tax is applicable.

- There are also local inheritance taxes, as well as state inheritance taxes. If no regional guidelines apply, the Spanish Civil Code takes precedence.

Inheritance tax rate in Spain

| Inheritance |

Percentage |

| Up to €7,993: |

7.65% |

| €7,993 – €31,956 |

7.65 to 10.2% |

| €31,956 – €79,881 |

10.2 to 15.3% |

| €79,881 – €239,389 |

15.3 to 21.25% |

| €239,389 – €398,778 |

25.5% |

| €398,778 – €797,555 |

29.75% |

| €797,555+ |

34% |

Capital gains tax in Spain

Capital Gains Tax in Spain is a tax that people must pay when they sell, transfer or redeem any type of financial asset. Typically, the Capital Gains Tax concerns people that are selling a property for profit. Capital gains tax will apply if you sell an investment at a higher price than you originally bought it for.

Assets that are liable for Capital gains tax

This tax is not only levied on the sale of real estate alone, as it can also apply to the sale of financial assets. Other items that are included are:

- Stocks

- Collectables

- Bonds

- Buildings, lands, houses and flats

- Precious metals, Jewelry

Now that you know for which assets you must pay capital gains tax let’s look at the rate.

Capital gains tax for residents

According to Spanish tax laws, if you’re a resident, you are applied a scale between 19% and 23% and can get tax relief if you have lived in the property for at least three years before selling it. You will pay:

- 19% for the first 6.000€ obtained as a profit.

- 21% between profits from 6.000€ to 50.000€.

- 23% on your profits that are 50.000€ and up.

Capital gains tax for non-residents

You’ll pay capital gains tax on your income from the sale of your property. The capital gains tax for non-residents from EU/EEA countries is 19%, for non-residents from other nations it’s 24%.

There are no exemptions for non-residents, except for one. Non-residents of Spain are eligible for a capital gains tax exemption if they are lawfully residing in any other European Union nation with a tax agreement with Spain. They will also benefit if they meet the condition for main home exemption.

If you would like help with your taxes when selling property, our capital gains tax in Spain article can help provide it. Furthermore, you can contact us for tailored legal guidance when buying or selling property in Spain.

Plusvalia Tax

The Plusvalia tax is a property tax levied by the Spanish government on the increase in the value of urban land. The goal of this tax is to tax the increase in the value of the land, whether there is a property on it or not. This tax is similar to the capital gains tax; only it is paid to the municipality.

The Plusvalia tax is payable when the transfer of ownership of the property is transferred via the Land Registry. This can happen when selling the property, donating the property, or inheriting the property. The amount of Plusvalia tax you have to pay depends on three factors, including the municipality where the land is located, the number of years you have owned the land, and the base (which is the value increase of the property). When you sell your home for a loss, the tax isn’t charged. You may pay the tax at your local town hall, tax office, or online.

The tax is calculated by multiplying the base (real or nominal capital gain) with a coefficient set by the government. The real capital gain is the difference between the purchase price of the land and the selling price of the land in the land registry. The nominal capital gain reflects the real property market, which means the real capital gain.

Property transfer tax

There is a variety of property taxes when buying a property in Spain. Property transfer tax in Spain is a tax imposed on any person buying a property from another person in Spain. The rate varies from autonomous region to autonomous region.

A property transfer tax must be paid if the home is regarded as a second or subsequent transfer in Spain. In the case of a new home, you don’t have to pay a transfer tax. The tax is usually between 6%-10%, and commonly the buyer will pay for it. It is a replacement for the VAT.

There is also stamp duty imposed by the region. This tax is a percentage of the purchase price, and you must pay it when buying real estate. Currently, the stamp duty is between 0.75% and 1.5%.

VAT taxes in Spain

The value added tax (VAT) or impuesto sobre el valor añadido (IVA) is the most common indirect tax. It taxes the consumption of goods and services by individuals and companies.

It is well known because it affects us all in our day-to-day life, and it is very little loved since it makes products more expensive, an issue that hinders the competitiveness of the seller and the purchasing power of the buyer.

In general, the IVA in Spain is 21%. However, because some products are more essential than others, Spain also has lower rates for essential products which are 10% and 4%.

- General: 21% on general goods and services

- Reducido: 10% on items such as agricultural supplies, mineral water, lemonade, fruit juice, passenger transport, hotel, and restaurants services, and alike.

- Super Reducido: 4% on items such as essential food, medicine, caregiver services, books, magazines, newspapers.

In our article dedicated to VAT in Spain, we discuss more how to calculate VAT, the rules surrounding VAT, and VAT refunds.

Corporate income taxes in Spain

The general corporate income tax in Spain is 25%. For the first two years of business, the rate for newly-formed firms is 15%. The most common limited company entity is the Limited Company (SL). There are some exemptions for certain companies:

- Listed collective investment institutions, including real estate investment funds, have a corporate tax rate of 1%.

- Certain cooperatives will have a corporate tax rate of 20%.

- Entities engaging in oil and gas research and activities will have a corporate tax rate of 30%.

- Listed corporations for investment in the real estate market will have a corporate tax rate of 19%.

How to pay taxes in Spain

To pay taxes, you will need to get a NIE. A NIE number is a Número de Identificación de Extranjero. It is a unique tax identifier assigned to foreign nationals in Spain. You may obtain this number through the local Foreigner’s Office (“Oficina de Extranjeros”) or a police station. You must do so within 30 days of your arrival in Spain. Then, to declare your responsibility to pay Spanish tax for the first time, you must fill out Form 30 (Modelo 30). When you have your NIE you can register with the “Agencia Tributaria”, and start filing your taxes.

Special expat tax rule: The Beckham Law

Non-resident individuals in Spain who move to the country and acquire their tax residence there become residents for tax purposes. However, if they meet certain requirements, there is a special tax regime that they can take advantage of, known as the ‘Beckham Law‘ or ‘Beckham Clause’.

This specific regime allows these residents for tax purposes to pay taxes according to the regulations of non-residents during their first six years. In practice, this means paying a fixed rate of 24% instead of a progressive one that can go up to 45% if it exceeds 600,000 euros per year.

The ‘Beckham Law’, which tax deduction can also apply to administrators of companies incorporated in Spain that do not own more than 25% of the company, is generally used “for employees who move to Spain under a new employment contract or with one already existing.”

Although the Beckham law is the most commonly used path to save taxes, another alternative can help you become a non-resident for tax purposes. It may be the right strategy if you don’t meet the requirements of the Beckham regime. We refer to those cases where your employer is not in Spain, but you live permanently in Spanish territory as a foreigner.

Spanish double taxation treaties

Spain has signed treaties with about a hundred countries to avoid double taxation. These treaties aim to prevent both countries from taxing your income or capital gains, where you can claim the credit against your Spanish tax liability for taxes paid abroad.

There are many cases in which individuals don’t have to pay tax on their foreign-earned income, and there are only some conditions you need to meet. Where conditions are met, foreign tax paid on income not taxable in Spain may be credited against Spanish tax.

For example, suppose you are a US citizen and pay US tax on your worldwide income, including interest earned on investments made with savings while living in Spain. In that case, you can claim credit for the US taxes paid against any eventual Spanish liability. The Spanish tax credit is usually limited to the amount of Spanish tax owed on the total taxable income of an individual. For this rule to work, you must be a non-resident for tax purposes.

In addition to the above, nationals from some countries sign special agreements with Spain to benefit from a special reduction in their Spanish taxes.

Tax Refund

How to get your tax refund depends on what type of residential status you have.

Resident for tax purposes:

Tax residents can get a tax refund by filing their annual income tax returns.

Non-resident individuals:

Non-residents can get taxes paid in Spain reimbursed. To do so, they must file a tax return and meet some requirements.

Want to hire a professional tax-deducted service?

Now you know what the central taxes are paid in Spain, both direct or indirect. If you are thinking of starting a business or already have one, you are very likely not optimising your taxes to the maximum and are paying more. So, consult with an accountant service in Spain, and consider Spain Desk. Here, you can get guidance from professionals and your taxes efficiently in Spain.

For more information on the Spanish tax system, you can visit the Ministry of Finance and Public Administration.

Disclaimer: Information on this page may be incomplete or outdated. Under no circumstances should the information listed be considered professional legal advice. We highly recommend seeking guidance from a legal expert if you lack extensive knowledge or experience dealing with any of the procedures outlined in these articles.

Get taxes done more quickly and efficiently with our tax services in Spain